Astrea 9

Invest For Your Future

Astrea 9 offers three classes of bonds, Class A-1, A-2 and Class B PIK backed by cash flows from a quality diversified portfolio of PE Funds managed by reputable GPs.

Only Class A-1 Bonds and Class A-2 Bonds are offered to retail investors in Singapore.

- Over-collateralisation - portfolio NAV more than twice of total bonds issued

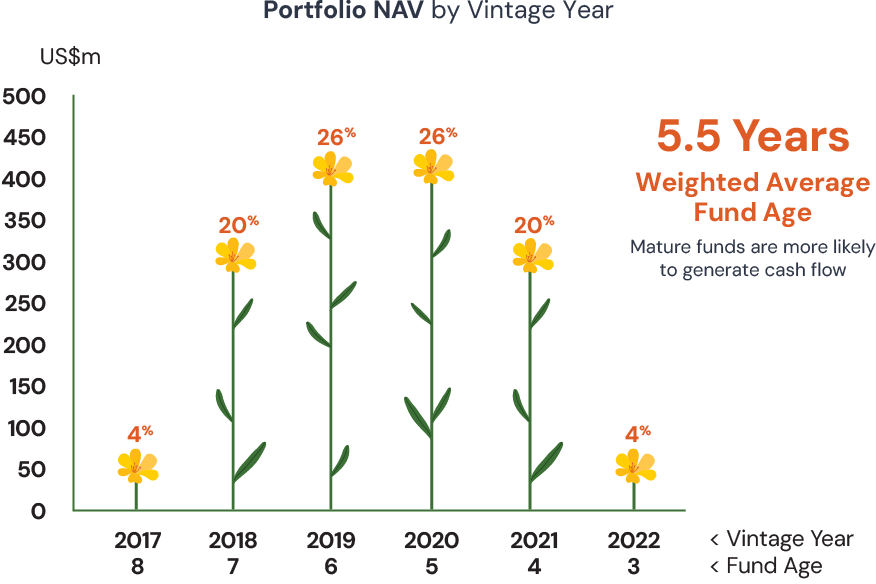

- Quality diversified portfolio of 40 PE Funds across 6 vintage years and 1,086 investee companies

- Mature, cash generative portfolio with 5.5 years weighted average age

- Structural safeguards in place

Sponsor (Azalea Group) holds 100% equity interest

| Class | Principal Amount | Interest Rate | Scheduled Call Date | Interest Rate Step-up | Expected Ratings (Fitch1) | Maturity Date |

|---|---|---|---|---|---|---|

| Class A-1 | S$615 million (US$480) million • Public offer: S$380m • Placement: S$235m | 3.40% p.a. | 8 August 2030 (5 Years) | 1.0% p.a. | A+sf | 8 August 2040 |

| Class A-2 | US$200 million • Public offer: US$50m • Placement: US$150m | 5.70% p.a. | 8 August 2030 (5 Years) | 1.0% p.a. | Asf | 8 August 2040 |

| Subtotal | US$680 million | |||||

| Class B PIK | US$100 million | 7.35% PIK | n/a | n/a | BBBsf | 8 August 2040 |

| Total | US$780 million | |||||

1 Fitch has not provided its consent, for the purposes of Section 249 of the SFA, to the inclusion of the information cited and attributed to it in the Prospectus, and is therefore not liable for such information under Sections 253 and 254 of the SFA (as described in the section “Credit Ratings” of the Prospectus)

Click this link to access the Fitch Presale Ratings Report.

Class A-1 Bonds – S$380m Class A-1 Bonds offered to retail investors in Singapore (Stock Code: YA1B)

- Cash reserved every 6 months to repay principal of Class A-1 bonds

- Mandatory Call at end of Year 5 (8 August 2030), if the Class A-1 Call Date Exercise Conditions are met

- Fixed interest of 3.4% p.a. payable every six months

- 1.0% p.a. one-time interest rate step-up if bond is not redeemed after 5 years

- Class A-1 and Class A-2 rank equally to each other (pari passu)

Class A-2 Bonds – US$50m Class A-2 Bonds offered to retail investors in Singapore (Stock Code: YA2B)

- Cash reserved every 6 months to repay principal of Class A-2 bonds

- Mandatory Call at end of Year 5 (8 August 2030), if the Class A-2 Call Date Exercise Conditions are met

- Fixed interest of 5.7% p.a. payable every six months

- 1.0% p.a. one-time interest rate step-up if bond is not redeemed after 5 years

- Class A-1 and Class A-2 rank equally to each other (pari passu)

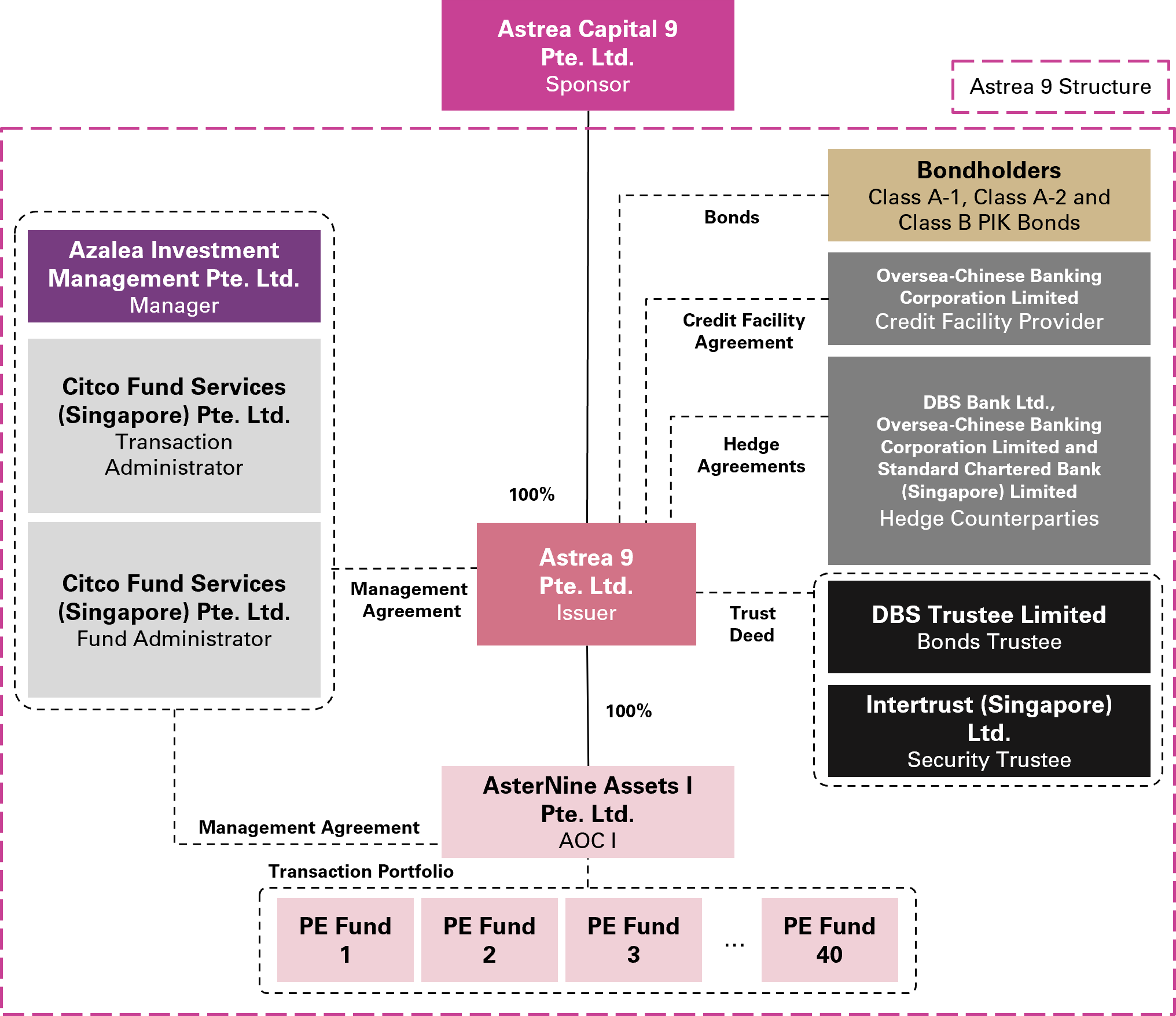

The Transaction Structure

The following diagram illustrates the structure through which the three Classes of Bonds will be issued.

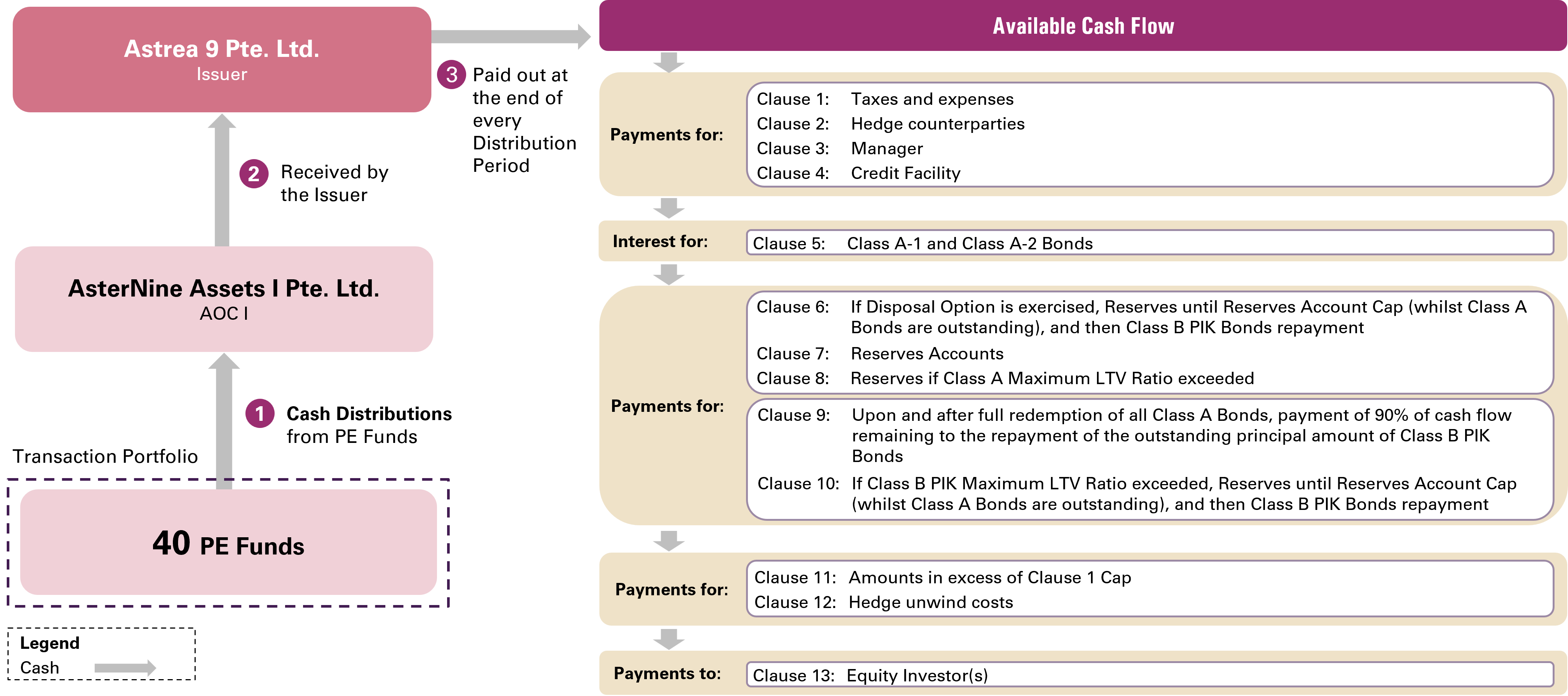

Simplified Cash Flow & Priority of Payments

Cash distributions from PE Funds are received by the Issuer. The Issuer then pays out available cash through the Priority of Payments semi-annually.

Below is a simplified illustration of the cash flow and the Priority of Payments.

Structural Safeguards

Reserves Accounts

Cash build-up to repay principal amounts of Class A-1 Bonds and Class A-2 Bonds on 8 August 2030 at the earliest

Maximum Loan-to-Value (LTV) Ratio

Crossing the Class A Total Net Debt limit of 50% triggers the lowering of debt level

Crossing the Class A and Class B PIK Total Net Debt limit of 55% triggers the lowering of debt level

Credit Facility

To fund certain expenses and capital calls for fund investments, if cash flow shortfall occurs

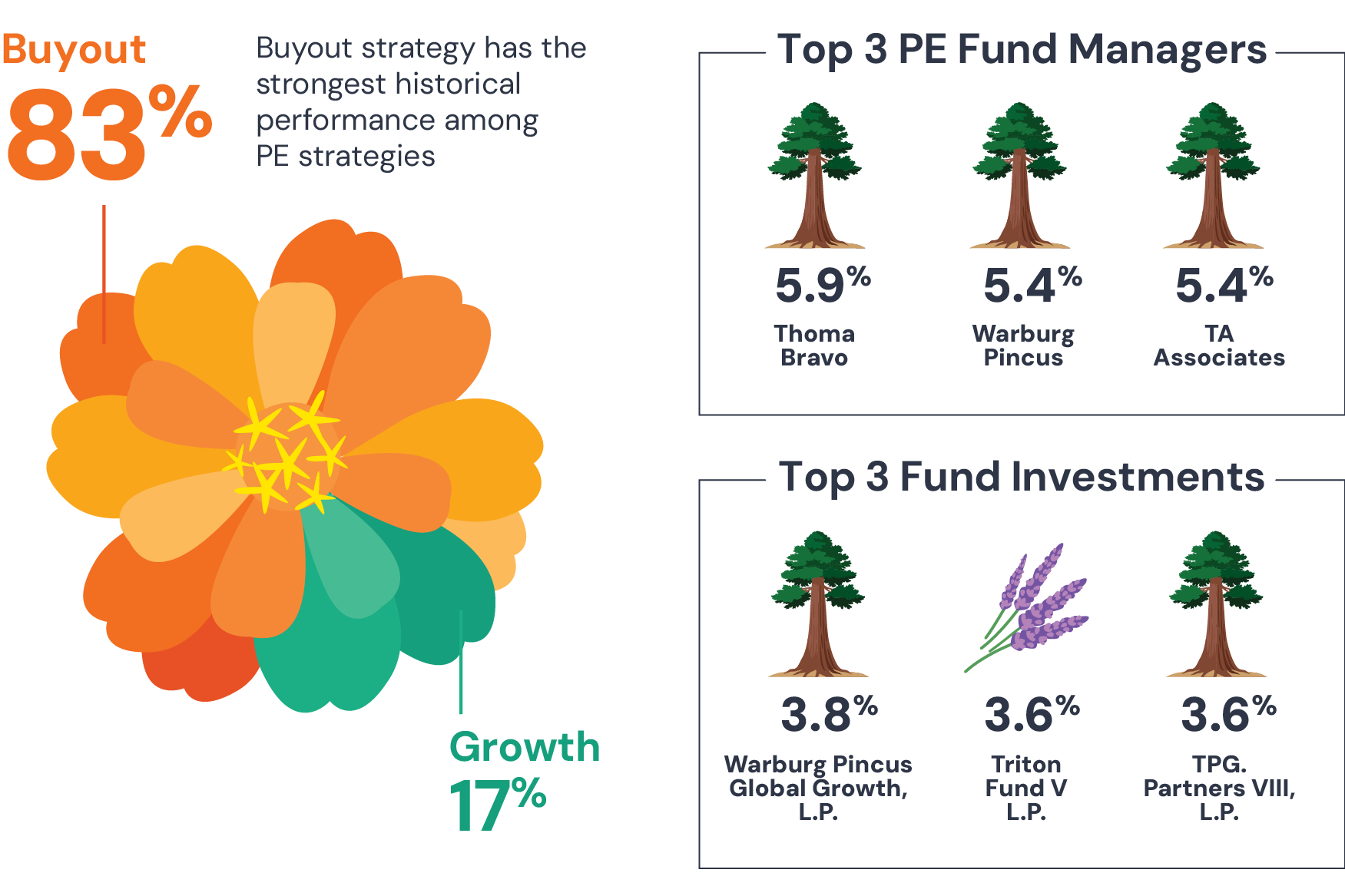

Astrea 9 Transaction Portfolio

The quality Transaction Portfolio is diversified across 40 PE Fund Investments, managed by 31 GPs and invested across 1,086 Investee Companies. The Transaction Portfolio has a weighted average fund age of 5.5 years and is mature and can be cash generative. The Net Asset Value, Undrawn Capital Commitments, Total Exposure and Capital Commitments are based on available reported figures as of 31 December 2024.

| Number of PE Funds | 40 |

| Number of GPs | 31 |

| Number of Investee Companies (as of 31 December 2024) | 1,086 |

| Weighted Average Age | 5.5 years |

| Range of Vintage Years | 2017 - 2022 |

| US$m | |

|---|---|

| Net Asset Value (NAV) | $1,625.2 |

| Undrawn Capital Commitments | $303.7 |

| Total Exposure | $1,928.9 |

| Capital Commitments | $1,609.2 |

The Prospectus in respect of the offering by Astrea 9 Pte. Ltd. of the Class A-1 Bonds and Class A-2 Bonds in Singapore is available for collection at selected DBS/POSB/OCBC branches during operating hours until 12:00 noon on 6 August 2025 and anyone wishing to acquire the Class A-1 Bonds and/or Class A-2 Bonds will need to make an application in the manner set out in the Prospectus.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

The public offers of the Class A-1 Bonds and Class A-2 Bonds are not directed at any investors outside of Singapore. IN PARTICULAR, THESE MATERIALS ARE NOT DIRECTED AT, AND SHOULD NOT BE ACCESSED BY (I) PERSONS LOCATED IN THE UNITED STATES OR US PERSONS OR (II) INVESTORS IN THE EUROPEAN ECONOMIC AREA OR THE UNITED KINGDOM.

July 30, 2025

Astrea 9 Management Presentation

July 30, 2025

Astrea 9 Private Equity Bonds

July 30, 2025

Astrea 9 Private Equity Bonds – Chinese Subtitles

July 30, 2025

What Are Private Equity Bonds

July 30, 2025

What Are Private Equity Bonds – Chinese Subtitles

IPO FAQs

Introduction

This Frequently Asked Questions page is to be read together with the Prospectus dated 30 July 2025, and Product Highlights Sheet dated 30 July 2025.

The information on this page, the Prospectus and Product Highlights Sheet should be read as of their respective dates, unless otherwise specified or determined by the context.

All dates and times are Singapore dates and times.

If you have any questions that have not been answered here, feel free to contact us via the contact form here.

About the Class A-1 Bonds and Class A-2 Bonds

Class A-1 Bonds and Class A-2 Bonds are being offered to the retail public in Singapore. Class B PIK* Bonds are offered to certain institutional or accredited investors in Singapore and elsewhere outside the United States, but they are not offered to the retail public in Singapore.

*‘PIK’ refers to payment-in-kind, which means that the accrued interest payable at the end of each distribution period is added to the original principal and forms part of the principal amount, compounded over time.

A portion of the Class A-1 Bonds placement (S$235m) and Class A-2 Bonds placement (US$150m) were offered to institutional investors who set the interest rate based on a bookbuilding exercise.

The remaining S$380m Class A-1 Bonds and US$50m Class A-2 Bonds were offered to retail investors at the same interest rate under the respective public offers.

Firstly, the Class A-1 Bonds are denominated in S$ while Class A-2 Bonds are denominated in US$.

Secondly, whilst both Class A-1 Bonds and Class A-2 Bonds are expected to have investment-grade credit ratings, the rating of Class A-1 Bonds is expected to be higher than the Class A-2 Bonds.

Thirdly, Class A-1 Bonds bear interest at a rate of 3.4% p.a. while Class A-2 Bonds bear interest at a rate of 5.7% p.a..

Fourthly, if the Class A-1 Bonds and Class A-2 Bonds are not redeemed on their respective Scheduled Call Date, their annual interest rates will step-up one-time to 4.4% and 6.7% respectively after these dates.

Please refer to question 6 on redemption in this FAQ section, including the possibility of Class A-2 Bonds being redeemed after the Class A-1 Bonds.

The Reserves Accounts (which cater for the principal repayments of Class A-1 Bonds and Class A-2 Bonds) are set up to receive equal payments of US$75 million from the first to the tenth Distribution Dates.

Please refer to the “Priority of Payments” and the “Reserves” sections of the Prospectus for details.

The Issuer and Manager observe that the legal maturities of other similar PE-backed bonds in the market are typically 15 years. As such, the legal maturities of the Astrea 9 PE Bonds align with other similar PE-backed bonds in the market. Investors can compare similar transactions on an apple-to-apple basis, which will better demonstrate the relative quality of the Astrea 9 PE Bonds with other similar PE-backed bonds.

Both Class A-1 Bonds and Class A-2 Bonds are subject to a mandatory call at the end of year 5, if relevant conditions are met.

It is mandatory for the Issuer to redeem the Class A-1 Bonds and Class A-2 Bonds on their respective Scheduled Call Date, both of which fall on 8 August 2030, if the relevant conditions are met. If not, redemption will take place in any subsequent period when such conditions are met.

If, on the Scheduled Call Date, there are sufficient reserves to redeem the Class A-1 Bonds only but not the Class A-2 Bonds (and no Credit Facility (CF) Loan) will remain unpaid on such date), the Class A-1 Bonds will be redeemed and redemption for the Class A-2 Bonds will take place at the next Distribution Date when the Class A-2 Call Date Exercise Conditions are met.

If the Class A-1 Bonds and Class A-2 Bonds are not redeemed on their respective Scheduled Call Date, their annual interest rates will step-up one-time to 4.4% and 6.7% respectively after these dates. The Maturity Date of 8 August 2040 is the latest date on which all outstanding Bonds will be redeemed in full.

Please refer to the “Terms and Conditions of the Class A-1 Bonds” and “Terms and Conditions of the Class A-2 Bonds” sections of the Prospectus for details.

‘sf’ means ‘structured finance’ and does not change the credit ratings. Final credit ratings of the Bonds will only be assigned on or after the issue date.

The Bonds are not guaranteed by any entity, including Temasek.

Risks

These may lead to a decline in PE asset valuations and/or reduction in exit activities, which may result in less distributions.

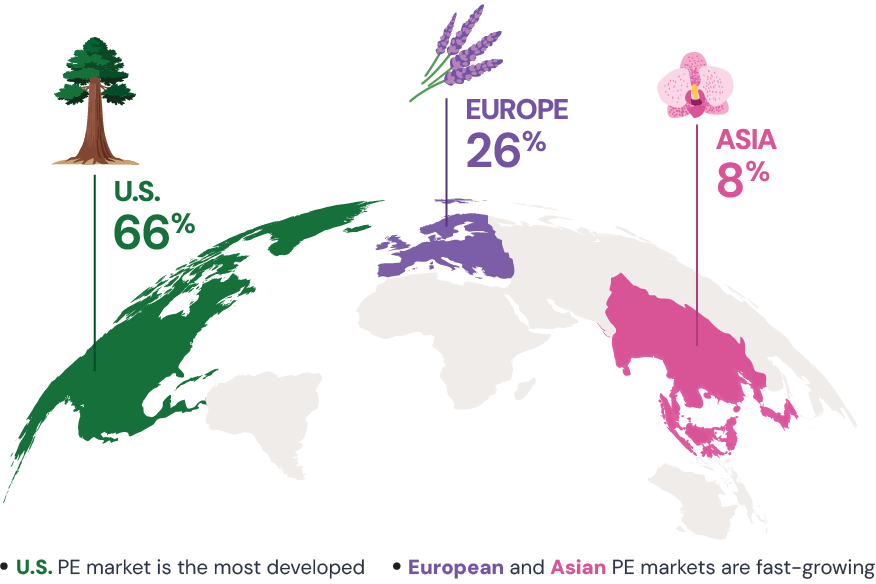

To mitigate these risks, the Transaction Portfolio is made up of 40 Fund Investments invested into 1,086 Investee Companies, diversified across vintages, regions and sectors. Astrea 9 also has structural safeguards designed to mitigate risks in your investment in the Class A-1 Bonds and/or the Class A-2 Bonds.

Please refer to the sections “Credit Facility”, “Reserves”, “Maximum Loan-To-Value Ratios”, as well as the “The Fund Investments” section of the Prospectus for details.

Please refer to question 11 on potential risks in this FAQ section.

All investments carry risks. This includes investments in bonds. Astrea 9 PE Bond investors face typical risks such as default, interest rate, liquidity, inflation risks, exchange rate risks, adverse macro-economic or market conditions (including those arising from rising or elevated inflation and/or interest rates, armed conflicts or a global pandemic) and other risks specific to private equity investments such as:

Investment Risk

The nature of private equity fund investments is that the amount and timing of distributions are uncertain. There is also limited disclosures regarding the performance of the underlying investee companies, some of which could potentially relate to a decline in returns or cash flows of the fund investments.

Market Risk

An adverse change in macro-economic conditions such as rising or elevated inflation and/or interest rates or market conditions resulting from events including changes in the geo-political landscape such as those arising from armed conflicts (for example, the Israel-Iran, the Russia-Ukraine or the Israel-Hamas conflict), trade tensions, adverse changes in laws, regulations and/or policies (including tariff policies), natural disasters or a global pandemic may lead to a decline in PE asset valuations and/or reduction in deal activities. This may lead to less distributions from Fund Investments if the underlying investments were sold during a period of declining asset valuations or deal activities.

Leverage Risk

Portfolio PE Funds are likely to employ leverage. Use of leverage may also increase exposure of Investee Companies to adverse financial or economic conditions and impair their ability to finance operational and capital needs. In particular, interest rates are subject to fluctuations, and there is no guarantee that they will remain stable or not increase further. The cumulative effect of the use of leverage and adverse financial or economic situations (such as downturns in the economy or deteriorations in the conditions of the Investee Companies or their subsidiaries) could result in substantial losses to the Portfolio PE Fund and/or the Investee Companies, and increasing or elevated interest rates could exacerbate such losses.

Exchange Rate Risk

Class A-2 Bondholders whose investment currency base is not in US$ may be subject to exchange rate fluctuations between their investment currency base and the US$. Such fluctuations may result in foreign exchange losses for these Class A-2 Bondholders.

The risks highlighted above are not exhaustive. Please refer to the section “Risk Factors” (in particular the subsection “- Characteristics of Bonds”) of the Prospectus for a discussion of certain risks in connection with an investment in the Class A-1 Bonds and Class A-2 Bonds.

Where to Find More Information

The Manager will be conducting a free Management Presentation Event on 4 August 2025, 6:30PM.

To sign up for the event, please click here. By signing up for the event, you confirm that you are an investor located in Singapore and are not a U.S. person.

Click here to download the Prospectus, or visit the SGX-ST website under the “Prospectus / Circulars / Offer Documents” section under the “Company Information” tab.

Printed copies of the Prospectus are available at selected DBS/POSB and OCBC bank branches during their opening hours over the Public Offer period:

DBS Ang Mo Kio Central Branch | Blk 712A, #01-4066, Ang Mo Kio Avenue 6, Singapore 561712 |

DBS MBFC Branch | 12 Marina Boulevard, Level 3, DBS Asia Central @ MBFC Tower 3, Singapore 018982 |

DBS Parkway Parade Branch | 80 Marine Parade Rd, #01-12, Parkway Parade, Singapore 449269 |

DBS Plaza Singapura Branch | 68 Orchard Rd, #B1-25, Plaza Singapura, Singapore 238839 |

OCBC Centre Branch | 65 Chulia Street Mezzanine Floor, OCBC Centre, Singapore 049513 |

OCBC Jurong East Branch | 50 Jurong Gateway Road, #B1-18, Jem, Singapore 608549 |

OCBC Northpoint Branch | 930 Yishun Avenue 2, #B1-36, Northpoint Shopping Centre, Singapore 769098 |

OCBC Tampines Branch | 1 Tampines Central 5, #01-04/05 CPF Tampines Building, Singapore 529508 |

POSB Waterway Point Branch | 83 Punggol Central, #B2-09, Singapore 828761 |

You may also visit the Astrea 9 Transaction page for information on the Bonds.

Applying for the Class A-1 Bonds and Class A-2 Bonds

Yes, you may make one application for Class A-1 Bonds and one separate application for Class A-2 Bonds during the offering period.

Each application under the Class A-1 Public Offer must be at least S$2,000 or higher (in multiples of S$1,000) in principal amount of Class A-1 Bonds.

Each application under the Class A-2 Public Offer must be at least US$2,000 or higher (in multiples of US$1,000) in principal amount of Class A-2 Bonds.

No. Class A-2 Bonds are only offered as a US$ denominated bond.

Please refer to question 11 on exchange rate risk in this FAQ section.

The Class A-1 Bonds and Class A-2 Bonds under the Public Offer will be open for application from 9:00am on 31 July 2025 and close on 6 August 2025, 12:00 noon.

You may apply using one of the following manners:

- ATMs of DBS (including POSB), OCBC and UOB

- Internet banking websites of DBS (including POSB), OCBC and UOB

- Mobile banking application of DBS (including POSB), OCBC and UOB

You will need to have a direct Securities Account with Central Depository (CDP) before you can submit an application.

You can make an electronic application for the Class A-2 Bonds in the same manner as Class A-1 Bonds under the respective public offers. While the Class A-2 Bonds are US$ denominated, applications for these Bonds will be made in S$ based on a predetermined exchange rate of US$1.00:S$1.2852.

No, all refunds of unsuccessful or partially allocated applications will also be credited in S$ based on the same predetermined exchange rate of US$1.00:S$1.2852 during application.

Although interest and principal payments on the US$ denominated Class A-2 Bonds are made by the Issuer in US$, if you are a direct securities account holder of CDP who has applied for CDP’s Direct Crediting Service (allowing CDP to credit cash distributions into your designated bank account), you will receive these payments in S$ by default (converted by CDP at such exchange rate provided by CDP’s partner bank).

You may opt-out from receiving payments in S$ via CDP Internet. Upon opting out, your foreign currency cash distribution will not be converted. It will remain in your cash balance with CDP. Please note there is telegraphic transfer fee imposed by CDP in addition to applicable receiving bank charges per withdrawal request.

For more information, refer to the Currency Conversion Service (CCY) section under CDP’s FAQ page at https://www.sgx.com/cdpfaqs.

A non-refundable administrative fee of S$2 is paid by the applicant for each application.

All on-going fees and expenses for the Astrea 9 transaction will be paid by Astrea 9, and not by the Astrea 9 Bondholders.

Please ensure you submit only one valid application for a Class of Bonds under its public offer. This means that you can apply once each for Class A-1 Bonds and Class A-2 Bonds.

Reasons for invalid applications may include:

- Making multiple applications for a Class of Bonds

- Applying using a joint Central Depository (CDP) account

- NRIC/FIN/Passport number differs in bank records and CDP records

- Name in application differs in bank records and CDP records

You will not be able to withdraw your application once it is submitted through ATM, internet banking, or mobile banking.

No, you will not be able to apply for the Bonds using CPF or SRS.

- 31 July 2025 (Thursday) – Opening of Public Offer at 9:00am

- 6 August 2025 (Wednesday) – Closing of Public Offer at 12:00 noon

- 7 August 2025 (Thursday) – Allocation & Balloting

- 8 August 2025 (Friday) – Issuance of Bonds and Settlement

- 11 August 2025 (Monday) – Listing on SGX-ST, Trading starts

All valid applications will either be allocated or balloted after the Offer Closing Date in event of oversubscription of the Bonds.

Depending on demand, Astrea 9 plans to allocate valid applications as follows:

(a) all applications of S$50,000 or less for Class A-1 Bonds or US$50,000 or less for Class A-2 Bonds will be allocated in full or in part; and

(b) applications of more than S$50,000 for Class A-1 Bonds or more than US$50,000 for Class A-2 Bonds will be balloted, with successful applicants allocated in full or in part.

Astrea 9 reserves the right to change its allocation plan.

For successful applicants, the number of Class A-1 Bonds and/or Class A-2 Bonds allocated will be credited to your CDP account on 7 August 2025.

You can login to your CDP account after 5pm on 8 August 2025 to check if you have been allocated any Class A-1 Bonds and/or Class A-2 Bonds (as applicable).

CDP will also send you a notification within three Market Days of the crediting of the bonds to your CDP account.

If your application was partially successful, you will be refunded the balance. Refund of partially allocated applications of Class A-1 Bonds will be processed in S$. Refunds of partially allocated applications of Class A-2 Bonds will also be processed in S$ based on the same predetermined exchange rate of US$1.00:S$1.2852 during application.

Refunds will be credited to your bank account by 5pm on 8 August 2025.

IMPORTANT NOTICE

Bondholders may lose all or part of their investments arising from default risks, interest rate risks, liquidity risks, inflation risks, exchange rate risks, adverse macro-economic or market conditions (including those arising from rising or elevated inflation and/or interest rates, armed conflicts or a global pandemic) and other risks specific to private equity investments such as investment, market and leverage risks.

The Prospectus in respect of the offering by Astrea 9 Pte. Ltd. of the Class A-1 Bonds and Class A-2 Bonds in Singapore is available for collection at selected DBS/POSB and OCBC branches during operating hours until 12:00 noon on 6 August 2025 and anyone wishing to acquire the Class A-1 Bonds and/or Class A-2 Bonds will need to make an application in the manner set out in the Prospectus. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

ELECTRONIC VERSIONS OF THE MATERIALS YOU ARE SEEKING TO ACCESS ARE BEING MADE AVAILABLE ON THIS WEBPAGE BY ASTREA 9 PTE. LTD. (THE “COMPANY”) IN GOOD FAITH AND FOR INFORMATION PURPOSES ONLY.

THESE MATERIALS ARE NOT DIRECTED AT OR ACCESSIBLE BY (I) PERSONS LOCATED IN THE UNITED STATES OR TO US PERSONS OR (II) RETAIL INVESTORS IN THE EUROPEAN ECONOMIC AREA ("EEA") OR THE UNITED KINGDOM ("UK").

By clicking on the “I Agree” button, I certify that I am (i) not located in the United States or any other restricted jurisdiction and am not a U.S person (as defined in Regulation S) and (ii) not a retail investor in the EEA or the UK and I confirm that I am permitted to proceed to electronic versions of these materials.

These materials do not constitute or form a part of any offer or solicitation to purchase or subscribe for the securities mentioned therein (“Securities”) in the United States or in any jurisdiction in which such offer or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The Securities mentioned therein have not been and will not be registered under the U.S. Securities Act of 1933 (the “Securities Act”), and may not be offered, sold, resold, delivered or distributed, directly or indirectly, in or into United States or to, or for the account or benefit of, U.S. persons except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with the securities laws of any state or other jurisdiction of the United States.

If you are not permitted to view materials on this webpage or are in any doubt as to whether you are permitted to view these materials, please exit this webpage.

Prohibition of Sales To EEA and UK Retail Investors

The Securities are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA or the UK. No key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Securities or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Securities or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. No key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA") (the "UK PRIIPs Regulation”) for offering or selling the Securities or otherwise making them available to retail investors in the UK has been prepared and, therefore, offering or selling the Securities or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

By clicking on the “I Agree” button, I certify that if I am an investor in the EEA:

i. I am a “qualified investor” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”); or

ii. I am a non-qualified investor that commits to subscribe for securities in this offering to the total value of at least €100,000 for each separate offer in accordance with Article 1(4)(d) of the UK Prospectus Regulation.