Astrea VI

Invest For Your Future

The Astrea VI PE Bonds are the third listed retail bonds in Singapore backed by cash flows from Private Equity Funds. They represent the sixth series in the Astrea Platform and are a continuing step to bring listed retail bonds to investors in Singapore.

Portfolio Highlights

Bond information

Astrea VI Class A-1 Bonds

Stock code: 6AZB

The bonds began trading on the SGX-ST Mainboard on 19 March 2021.

- Tickers

- 6AZB

- ISIN

- SGXF34882443

- Bloomberg

- BBG00ZKSYNX4

- Date

- 17 Nov 2024

- Time

- 2:13am

- Share price

- $0.998

- Previous close

- $0.999

- Change

- -$0.001

- High

- $0.999

- Low

- $0.998

- Open

- $0.999

- Total Volume

- 81,000

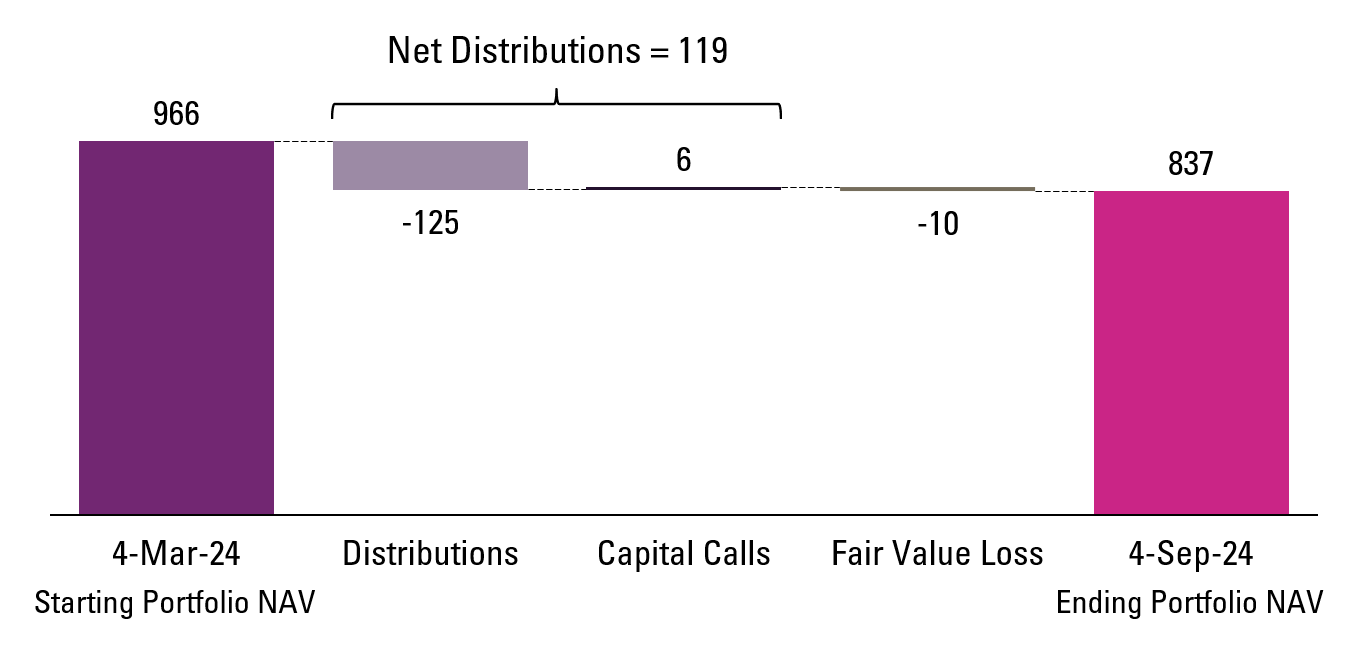

Portfolio Activity (US$)

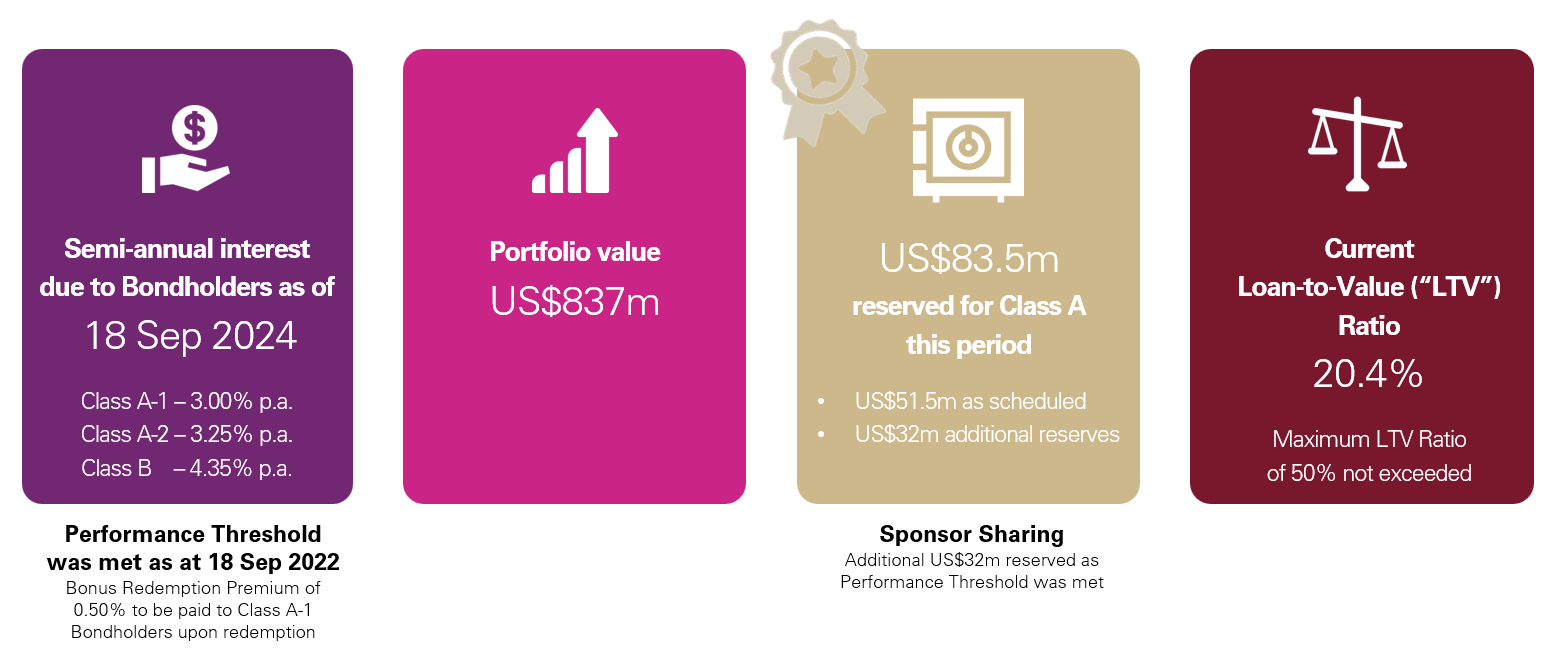

For the latest Distribution Period, US$125m of distributions were received from the PE Funds while US$6m was invested through capital calls. The net distributions of US$119m were applied to the Priority of Payments. These cash flow and unrealised fair value movements resulted in an ending Portfolio NAV of US$837m.

Performance Threshold was met as at 18 Sep 2022

The Performance Threshold was met as at 18 Sep 2022, thus there would be a Bonus Redemption Premium of 0.5% paid to Class A-1 Bondholders upon redemption. This also triggered Sponsor Sharing and an additional US$32m was reserved on top of the scheduled reserves for the Seventh Distribution Date (18 Sep 2024).

Outstanding Bonds

| Class | Class A-1 Bonds | Class A-2 Bonds | Class B Bonds |

| Principal Amount | S$382m (US$285m) | US$228m | US$130m |

| Interest Rate Per Annum | 3.00% | 3.25% | 4.35% |

| Interest Rate Step-Up Per Annum | 1.0% | 1.0% | N/A |

| Scheduled Call Date | 18 March 2026 | 18 March 2026 | N/A |

| Maturity Date | 18 March 2031 | 18 March 2031 | 18 March 2031 |

| Ratings (Fitch / S&P)1 | AA-sf2 / A+ (sf) | Asf / Not rated | Asf3 / Not rated |

Click the links to access the Fitch Ratings Report as well as S&P's Final Ratings Press Release and S&P's Presale Report.

1 Fitch and S&P have not provided their consent, for the purposes of Section 249 of the SFA, to the inclusion of the information cited and attributed to them in the Prospectus, and are therefore not liable for such information under Sections 253 and 254 of the SFA (as described in the section “Credit Ratings”).

2Rated A+sf at launch, Class A-1 Bonds were upgraded to AA-sf by Fitch on 13 Feb 2024. Click here for the press release.

3Rated BBBsf at launch, Class B Bonds were upgraded to BBB+sf by Fitch on 15 Feb 2022. Click here for the press release. The bonds were then upgraded from BBB+sf to Asf by Fitch on 13 Feb 2024. Click here for the press release.

Astrea VI Prospectus dated 9 March 2021

The Prospectus posted up on this website is being provided as a historical, reference source only and is not being used, and no one is authorised to use, disseminate or distribute it, in connection with any offer, invitation or recommendation to sell or issue, or any solicitation of any offer to purchase or subscribe for, securities. The Prospectus is current only as at its date and the availability of the Prospectus on this website shall not create any implication that there has been no change in the Issuer's affairs since the date of the Prospectus or that the information, statements or opinions contained therein is current as at any time subsequent to its date. The Issuer is not under any obligation to update the Prospectus. The Prospectus may contain forward-looking statements and these statements, if included, must be read with caution as set forth in the section "Forward-looking statements" in the Prospectus . All information contained in the Prospectus regarding the Fund Investments (as defined in the Prospectus) has not been prepared, reviewed or approved by any PE Fund (as defined in the Prospectus), the general partner or manager of any PE Fund, or any of their affiliates. The Issuer does not provide any advice relating to the business, financial, legal, taxation or investment matters of any recipient of any information or the information.