Bond Information

Astrea VI Class A-1 Bonds

Stock code: 6AZB

The bonds began trading on the SGX-ST Mainboard on 19 March 2021.

Identifiers

Stock Price

Portfolio Activity (US$)

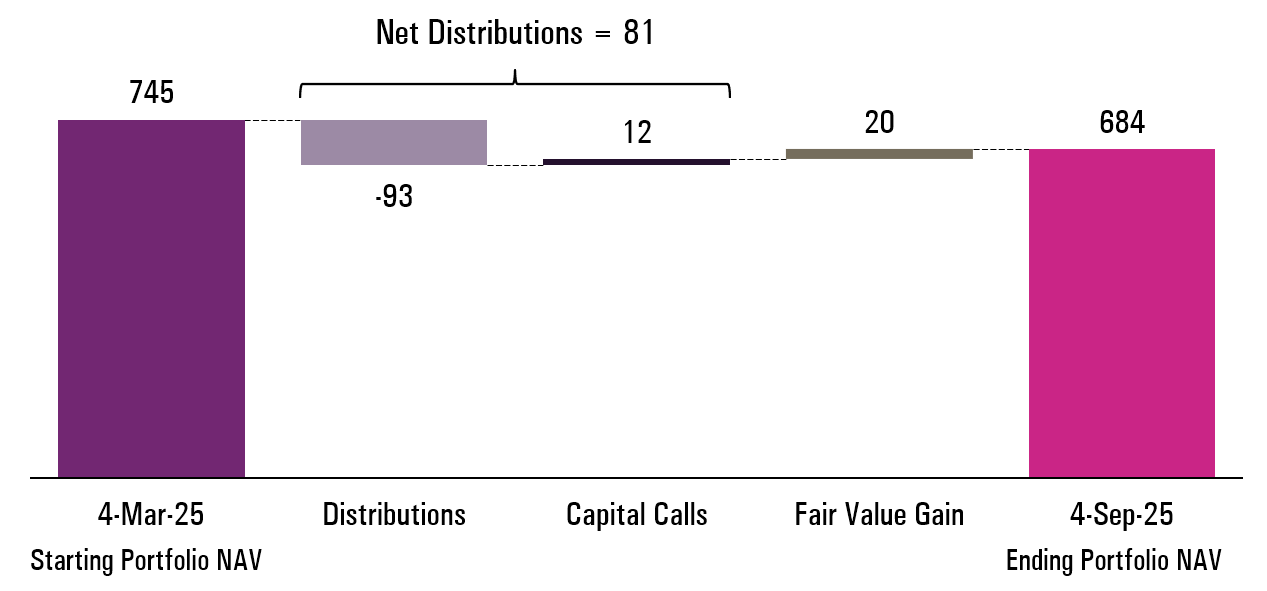

For the latest Distribution Period, US$93m of distributions were received from the PE Funds while US$12m was invested through capital calls. The net distributions of US$81m were applied to the Priority of Payments. These cash flow and unrealised fair value movements resulted in an ending Portfolio NAV of US$684m.

Class A Fully Reserved as at 18 Mar 2025

Outstanding Bonds

| Class | Class A-1 Bonds | Class A-2 Bonds | Class B Bonds |

|---|---|---|---|

| Principal Amount | S$382m (US$285m) | US$228m | US$130m |

| Interest Rate Per Annum | 3.00% | 3.25% | 4.35% |

| Interest Rate Step-Up Per Annum | 1.0% | 1.0% | N/A |

| Scheduled Call Date | 18 March 2026 | 18 March 2026 | N/A |

| Maturity Date | 18 March 2031 | 18 March 2031 | 18 March 2031 |

| Ratings (Fitch / S&P)1 | AA-sf2 / A+ (sf) | A+sf3 / Not rated | Asf4 / Not rated |

Click the links to access the Fitch Ratings Report as well as S&P's Final Ratings Press Release and S&P's Presale Report.

1 Fitch and S&P have not provided their consent, for the purposes of Section 249 of the SFA, to the inclusion of the information cited and attributed to them in the Prospectus, and are therefore not liable for such information under Sections 253 and 254 of the SFA (as described in the section “Credit Ratings”).

2Rated A+sf at launch, Class A-1 Bonds were upgraded to AA-sf by Fitch on 13 Feb 2024. Click here for the press release.

3Rated Asf at launch, Class A-2 Bonds were upgraded to A+sf by Fitch on 10 Dec 2024. Click here for the press release.

4Rated BBBsf at launch, Class B Bonds were upgraded to BBB+sf by Fitch on 15 Feb 2022. Click here for the press release. The bonds were then upgraded from BBB+sf to Asf by Fitch on 13 Feb 2024. Click here for the press release.

Videos

March 9, 2021

Astrea VI Management Presentation

March 9, 2021

Astrea VI Private Equity Bonds

May 31, 2018

What are Private Equity Bonds?

March 9, 2021

Astrea VI Private Equity Bonds - Chinese Subtitles

May 31, 2018

What are Private Equity Bonds? - Chinese Subtitles