Summary of Astrea IV Bonds

| Class | Class A-1 Bonds | Class A-2 Bonds | Class B Bonds |

|---|---|---|---|

| Principal Amount | S$242m (US$181m) | US$210m | US$110m |

| Bonds Redeemed | US$181m *fully redeemed* | US$210m *fully redeemed* | US$110m *fully redeemed* |

| Interest Rate Per Annum | 4.35% | 5.50% | 6.75%1 |

| Interest Rate Step-Up Per Annum | 1.0% | 1.0% | N/A |

| Scheduled Call Date | 14 June 2023 | 14 June 2023 | N/A |

| Maturity Date | 14 June 2028 | 14 June 2028 | 14 June 2028 |

| Ratings (Fitch / S&P)2 | AA-sf3 / AA- (sf)4 | A+sf5 / Not rated | Asf6 / Not rated |

| Redemption Premium | 0.5% of Class A-1 principal amount | N/A | N/A |

Click the links to access the Fitch Ratings Report as well as S&P's Presale Report.

1Future semi-annual interest payments of 6.75% per annum to Class B Bondholders will be based on the outstanding principal balance of the Class B Bonds..

2Fitch and S&P have not provided their consent, for the purposes of Section 249 of the Securities and Futures Act, Chapter 289 of Singapore (“SFA”), to the inclusion of the information cited and attributed to them in the Prospectus, and are thereby not liable for such information under Sections 253 and 254 of the SFA (as described in the section “Credit Ratings“ of the Prospectus).

3Rated Asf at launch, Class A-1 Bonds were upgraded to A+sf by Fitch on 17 May 2019. Click here for the press release. The bonds were then upgraded from A+sf to AA-sf by Fitch on 15 Feb 2022. Click here for the press release.

4Rated A (sf) at launch, Class A-1 Bonds were upgraded to A+ (sf) by S&P on 15 Nov 2021. Click here for the press release. The bonds were then upgraded from A+ (sf) to AA- (sf) by S&P on 23 December 2022. Click here for the press release.

5Rated Asf at launch, Class A-2 Bonds were upgraded to A+sf by Fitch on 22 Feb 2021. Click here for the press release.

6Rated BBBsf at launch, Class B Bonds were upgraded to Asf by Fitch on 15 Feb 2022. Click here for the press release.

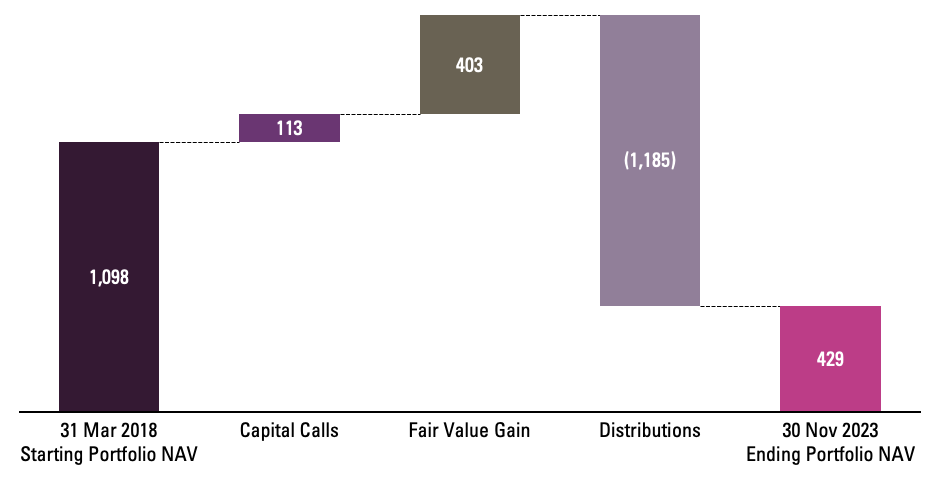

Performance of Astrea IV from Issuance to Redemption

(All amounts are in US$m unless otherwise stated)

- Strong distributions totalling >100% of initial portfolio NAV at issuance

- Substantial fair value gains due to strong performance of portfolio

Videos

June 9, 2018

Astrea IV Management Presentation

June 7, 2018

Astrea IV Private Equity Bonds

May 31, 2018

What are Private Equity Bonds?

June 7, 2018

Astrea IV Private Equity Bonds - Chinese Subtitles

May 31, 2018

What are Private Equity Bonds? - Chinese Subtitles