Summary of Astrea III Notes

| Class | Class A-1 Notes | Class A-2 Notes | Class B Notes | Class C Notes |

|---|---|---|---|---|

| Principal Amount | US$228m (US$170m) | US$170m | US$100m | US$112m1 |

| Notes Redeemed | US$170m *fully redeemed* | US$170m *fully redeemed* | US$100m *fully redeemed* | US$112m *fully redeemed* |

| Interest Rate Per Annum | 3.90% | 4.65% | 6.50% | 9.25% PIK |

| Interest Rate Step-Up Per Annum | 1.0% | 1.0% | N/A | N/A |

| Scheduled Call Date | 8 July 2019 | 8 July 2021 | - | - |

| Maturity Date | 8 July 2026 | 8 July 2026 | 8 July 2026 | 8 July 2026 |

| Ratings (Fitch / S&P) | A+sf2 / A+ (sf)3 | A+sf4 / Not rated | A+sf5 / Not rated | Not rated |

| Redemption Premium | 0.3% of Class A-1 principal amount | N/A | N/A | 5.0% of cash flows |

Click the links to access the Fitch Ratings Report as well as S&P's Presale Report.

1The Class C Principal includes 10 periods of PIK interest.

2The Class A-1 Notes were rated Asf at launch by Fitch and were upgraded to A+sf on 10 July 2017. Click here for the press release.

3The Class A-1 Notes were rated A (sf) at launch by S&P and were upgraded to A+ (sf) on 27 September 2017. Click here for the press release.

4The Class A-2 Notes were rated Asf at launch by Fitch and were upgraded to A+sf on 17 May 2019. Click here for the press release.

5The Class B Notes were rated BBBsf at launch by Fitch and were upgraded to BBB+sf on 17 May 2019. Click here for the press release. The notes were then upgraded from BBB+sf to Asf by Fitch on 28 April 2020. Click here for the press release. The notes were then upgraded from Asf to A+sf by Fitch on 22 Feb 2021. Click here for the press release.

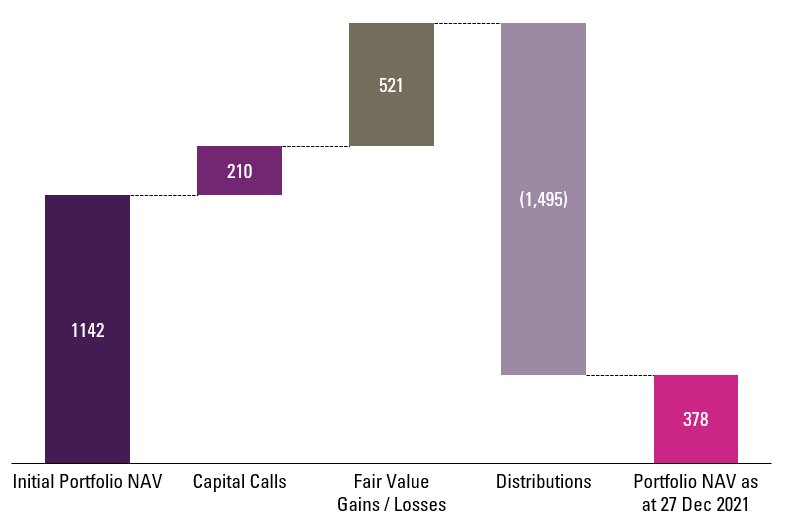

Performance of Astrea III from Issuance to Redemption

(All amounts are in $m unless otherwise stated)

- Strong distributions totaling >100% of initial portfolio NAV at issuance

- Substantial fair value gains due to strong performance of portfolio

Videos

May 31, 2018

What are Private Equity Bonds?

May 31, 2018

What are Private Equity Bonds? - Chinese Subtitles