Astrea 8

Invest For Your Future

Astrea 8 Transaction

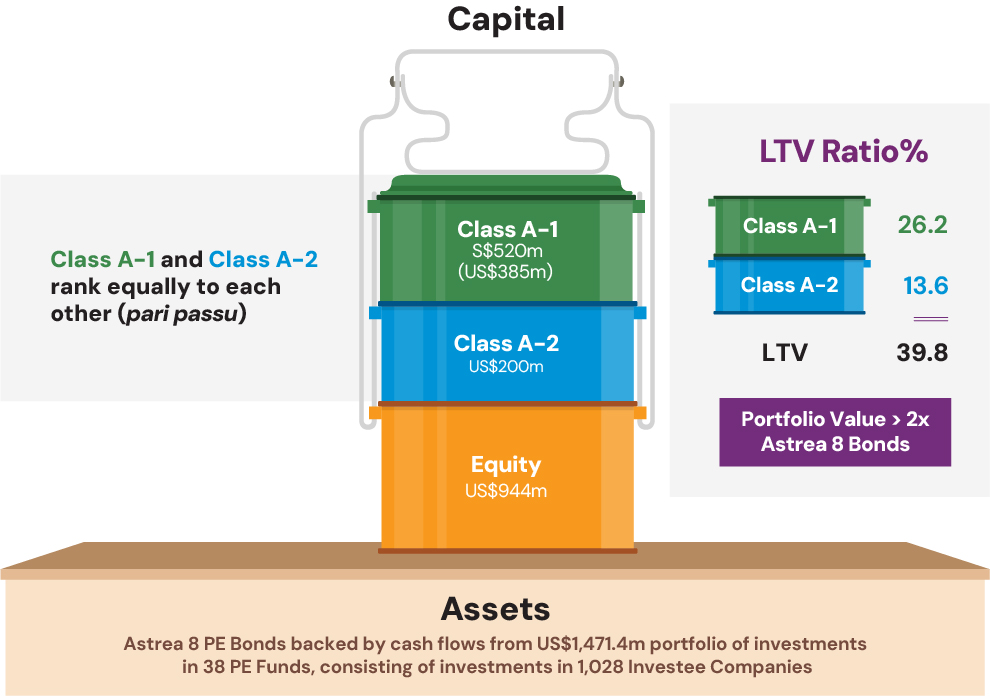

Astrea 8 offers two classes of bonds:

Class A-1 and A-2 backed by cash flows from a quality diversified portfolio of PE Funds managed by reputable GPs

- Over-collateralisation - Portfolio NAV 2.5 times of Total Bonds Issued

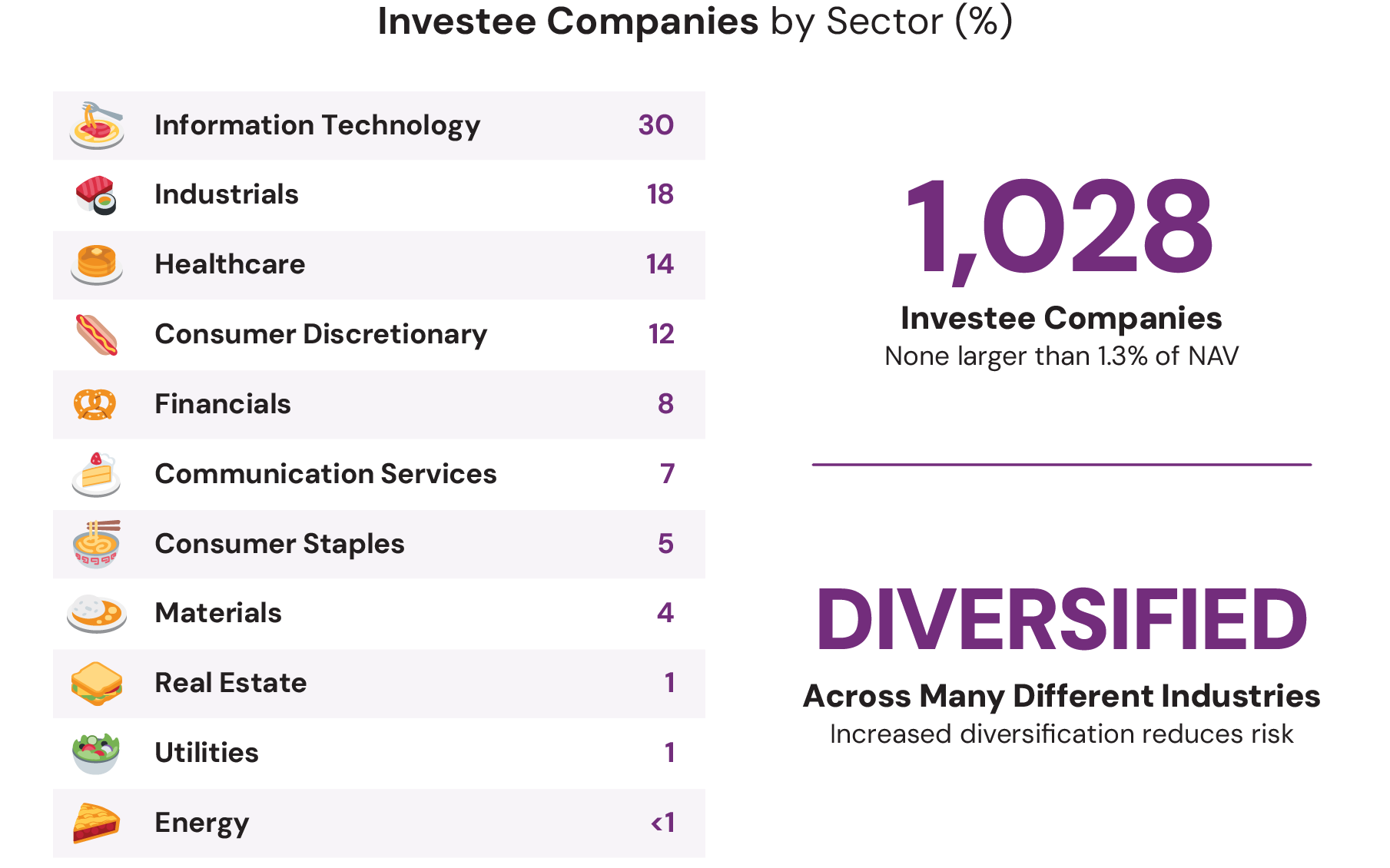

- Quality Diversified Portfolio of 38 PE Funds across 6 Vintage Years, 1,028 Investee Companies

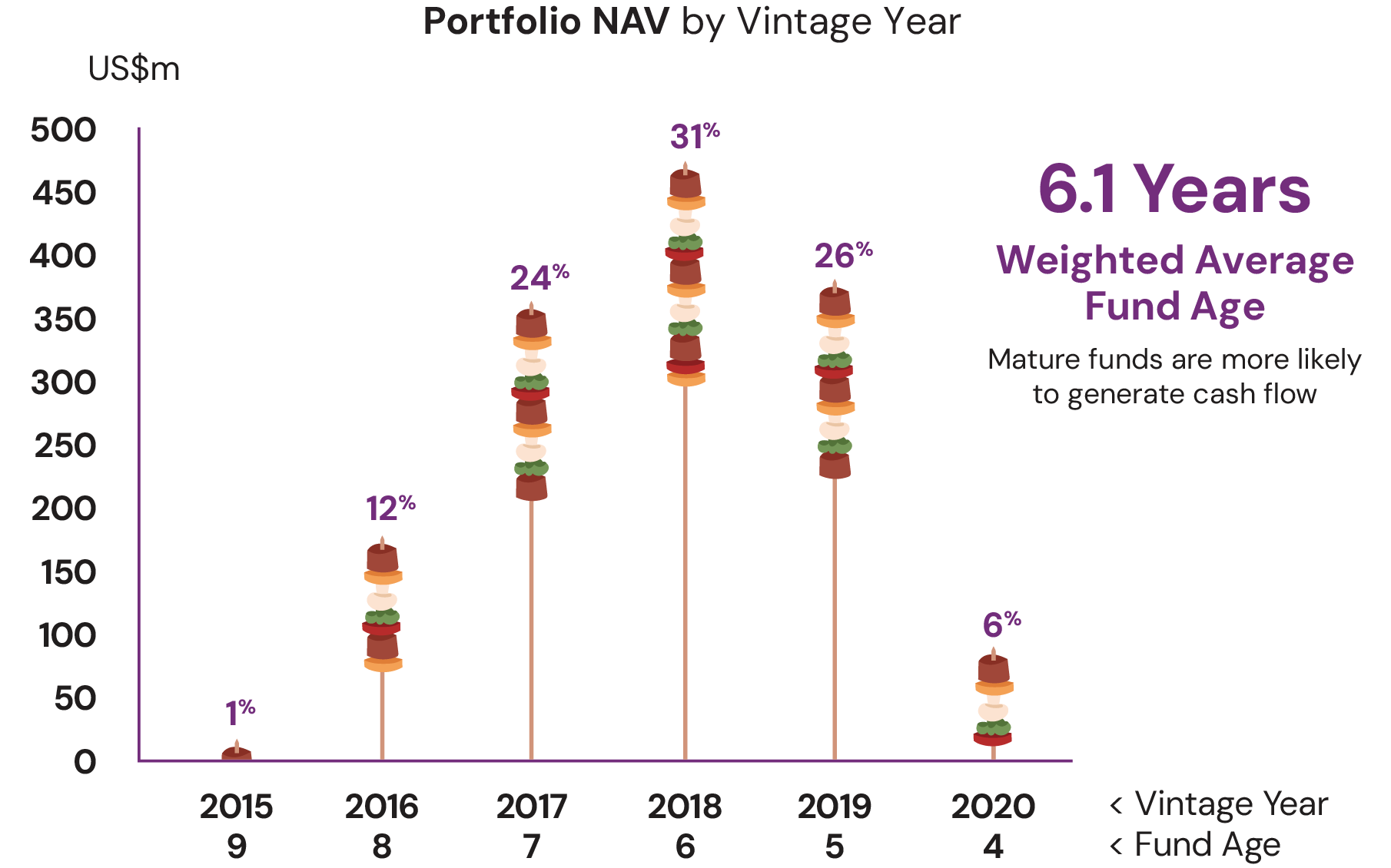

- Mature, Cash Generative Portfolio with 6.1 Years Weighted Average Age

- Structural Safeguards in Place

- Azalea Holds 100% Equity Interest

Class | Principal Amount | Interest Rate | Scheduled Call Date | Interest Rate Step-Up | Expected Ratings (Fitch)1 | Maturity Date |

A-1 | S$520 million (US$385 million) Public offer: S$260m Placement: S$260m | 4.35% p.a. | 19 July 2029 | 1.0% p.a. | A+sf | 19 July 2039 |

A-2 | US$200 million Public offer: S$50m Placement: S$150m | 6.35% p.a. | 19 July 2030 | 1.0% p.a. | Asf | 19 July 2039 |

1 Fitch has not provided its consent, for the purposes of Section 249 of the SFA, to the inclusion of the information cited and attributed to it in the Prospectus, and is therefore not liable for such information under Sections 253 and 254 of the SFA (as described in the section “Credit Ratings”).

Click the link to access the Fitch Presale Ratings Report.

Class A-1 Bonds – S$260m Class A-1 Bonds offered to retail investors in Singapore (Stock Code: Z1AB)

- Cash reserved every 6 months to repay principal of Class A-1 bonds

- Mandatory Call at end of Year 5 (19 July 2029), if conditions are met

- Fixed interest of 4.35% p.a. payable every six months

- 1.0% p.a. one-time interest rate step-up if bond is not redeemed after 5 years

- Class A-1 and Class A-2 rank equally to each other (pari passu)

Class A-2 Bonds – US$50m Class A-2 Bonds offered to retail investors in Singapore (Stock Code: Z2AB)

- Class A-2 will begin reserving after Class A-1 has been fully reserved or redeemed, whichever earlier

- Mandatory Call at end of Year 6 (19 July 2030), if conditions are met

- Fixed interest of 6.35% p.a. payable every six months

- 1.0% p.a. one-time interest rate step-up if bond is not redeemed after 6 years

The Transaction Structure

The following diagram illustrates the structure through which the two Classes of Bonds will be issued.

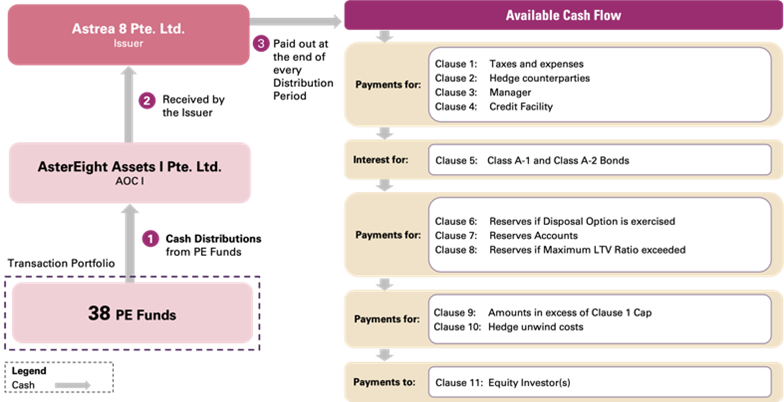

Simplified Cash Flow & Priority of Payments

Cash distributions from the PE Funds are received by the Issuer. The Issuer then pays out available cash through the Priority of Payments semi-annually.

Below is a simplified illustration of the cash flow and Priority of Payments.

Structural Safeguards

1. Reserves Accounts

Cash build up to repay principal of Class A-1 Bonds on 19 July 2029 and principal of Class A-2 Bonds on 19 July 2030 at the earliest

2. Maximum Loan-to-Value (LTV) Ratio

Crossing the debt level limit of 40% triggers lowering of Total Net Debt

3. Credit Facility

To fund certain expenses and capital calls for fund investments, if cash flow shortfall occurs

Astrea 8 Transaction Portfolio

The quality Transaction Portfolio is diversified across 38 PE Funds, managed by 27 GPs and invested across 1,028 Investee Companies. The Transaction Portfolio has a weighted average fund life of 6.1 years and is mature and cash generative. The Net Asset Value, Undrawn Capital Commitments, Total Exposure and Capital Commitments are based on best available reported figures as of 31 December 2023.

| Number of PE Funds | 38 |

| Number of GPs | 27 |

| Number of Investee Companies (as of 30 September 2021) | 1,028 |

| Weighted Average Age | 6.1 years |

| Range of Vintage Years | 2015 - 2020 |

| US$m | |

| Net Asset Value (NAV) | $1,471.4 |

| Undrawn Capital Commitments | $132.7 |

| Total Exposure | $1,604.1 |

| Capital Commitments | $1,252.4 |

Astrea 8 Prospectus dated 10 July 2024

IMPORTANT NOTICE

Bondholders may lose all or part of their investments arising from default, interest rate, liquidity, inflation risks, exchange rate risks, adverse macro-economic or market conditions (including those arising from rising or elevated inflation and/or interest rates, armed conflicts or global pandemics) and other risks specific to private equity investments such as investment, market and leverage risks.

The Prospectus in respect of the offering by Astrea 8 Pte. Ltd. of the Class A-1 Bonds and Class A-2 Bonds in Singapore is available for collection at selected DBS/POSB and OCBC branches during operating hours until 12.00 noon on 17 July 2024 and anyone wishing to acquire the Class A-1 Bonds and/or Class A-2 Bonds will need to make an application in the manner set out in the Prospectus. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

ELECTRONIC VERSIONS OF THE MATERIALS YOU ARE SEEKING TO ACCESS ARE BEING MADE AVAILABLE ON THIS WEBPAGE BY ASTREA 8 PTE. LTD. (THE “COMPANY”) IN GOOD FAITH AND FOR INFORMATION PURPOSES ONLY.

THESE MATERIALS ARE NOT DIRECTED AT OR ACCESSIBLE BY (I) PERSONS LOCATED IN THE UNITED STATES OR TO US PERSONS OR (II) RETAIL INVESTORS IN THE EUROPEAN ECONOMIC AREA ("EEA") OR THE UNITED KINGDOM ("UK").

By clicking on the “I Agree” button, I certify that I am (i) not located in the United States or any other restricted jurisdiction and am not a U.S person (as defined in Regulation S) and (ii) not a retail investor in the EEA or the UK and I confirm that I am permitted to proceed to electronic versions of these materials.

These materials do not constitute or form a part of any offer or solicitation to purchase or subscribe for the securities mentioned therein (“Securities”) in the United States or in any jurisdiction in which such offer or solicitation would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The Securities mentioned therein have not been and will not be registered under the U.S. Securities Act of 1933 (the “Securities Act”), and may not be offered, sold, resold, delivered or distributed, directly or indirectly, in or into United States or to, or for the account or benefit of, U.S. persons except pursuant to an applicable exemption from the registration requirements of the Securities Act and in compliance with the securities laws of any state or other jurisdiction of the United States.

If you are not permitted to view materials on this webpage or are in any doubt as to whether you are permitted to view these materials, please exit this webpage.

Prohibition of Sales To EEA and UK Retail Investors

The Securities are not intended to be offered, sold or otherwise made available to and should not be offered, sold or otherwise made available to any retail investor in the EEA or the UK. No key information document required by Regulation (EU) No 1286/2014 (as amended, the “PRIIPs Regulation”) for offering or selling the Securities or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling the Securities or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation. No key information document required by Regulation (EU) No 1286/2014 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (“EUWA") (the "UK PRIIPs Regulation”) for offering or selling the Securities or otherwise making them available to retail investors in the UK has been prepared and, therefore, offering or selling the Securities or otherwise making them available to any retail investor in the UK may be unlawful under the UK PRIIPs Regulation.

By clicking on the “I Agree” button, I certify that if I am an investor in the EEA:

i. I am a “qualified investor” within the meaning of Article 2(e) of Regulation (EU) 2017/1129 (as amended, the “Prospectus Regulation”); or

ii. I am a non-qualified investor that commits to subscribe for securities in this offering to the total value of at least €100,000 for each separate offer in accordance with Article 1(4)(d) of the UK Prospectus Regulation.