Investor Education

Learn More

Private Equity: The What, Who and How

3 min read time

With trillions of dollars under management, Private Equity (“PE”) is a term you have likely encountered, yet its inner workings might seem cloaked in complexity. This series of educational guides is designed to unravel the intricacies of PE, offering a comprehensive overview that covers the what, who and how to give you a clearer understanding of the world of PE.

What Is Private Equity?

At its core, PE refers to a form of capital investment made into private companies, or the acquisition of public companies with the intent of taking them private. Unlike the stocks of publicly traded companies that anyone can buy or sell on open stock exchanges, PE investments are not publicly listed. The goal of PE is straightforward: to invest capital into a company, nurture and grow it, and eventually exit with a profit, thus generating a significant return on the investment.

One example of a PE success story was the acquisition and eventual sale of fashion retailer Hugo Boss, by Permira, a PE firm. Permira saw the fashion house's potential and transitioned it from a wholesale model to a predominantly retail-focused brand. Under their ownership, Hugo Boss's global footprint expanded, especially in Asia, increasing the number of its own retail stores threefold, which significantly bolstered profit margins. Sales soared by 60%, EBITDA more than doubled, and the share price hit record highs. Permira’s strategic guidance cultivated Hugo Boss into one of the top global fashion brands, culminating in a successful exit in 2015 that made Permira about twice its original investment after seven transformative years.

Where Does Private Equity Fit In The Range Of Asset Classes?

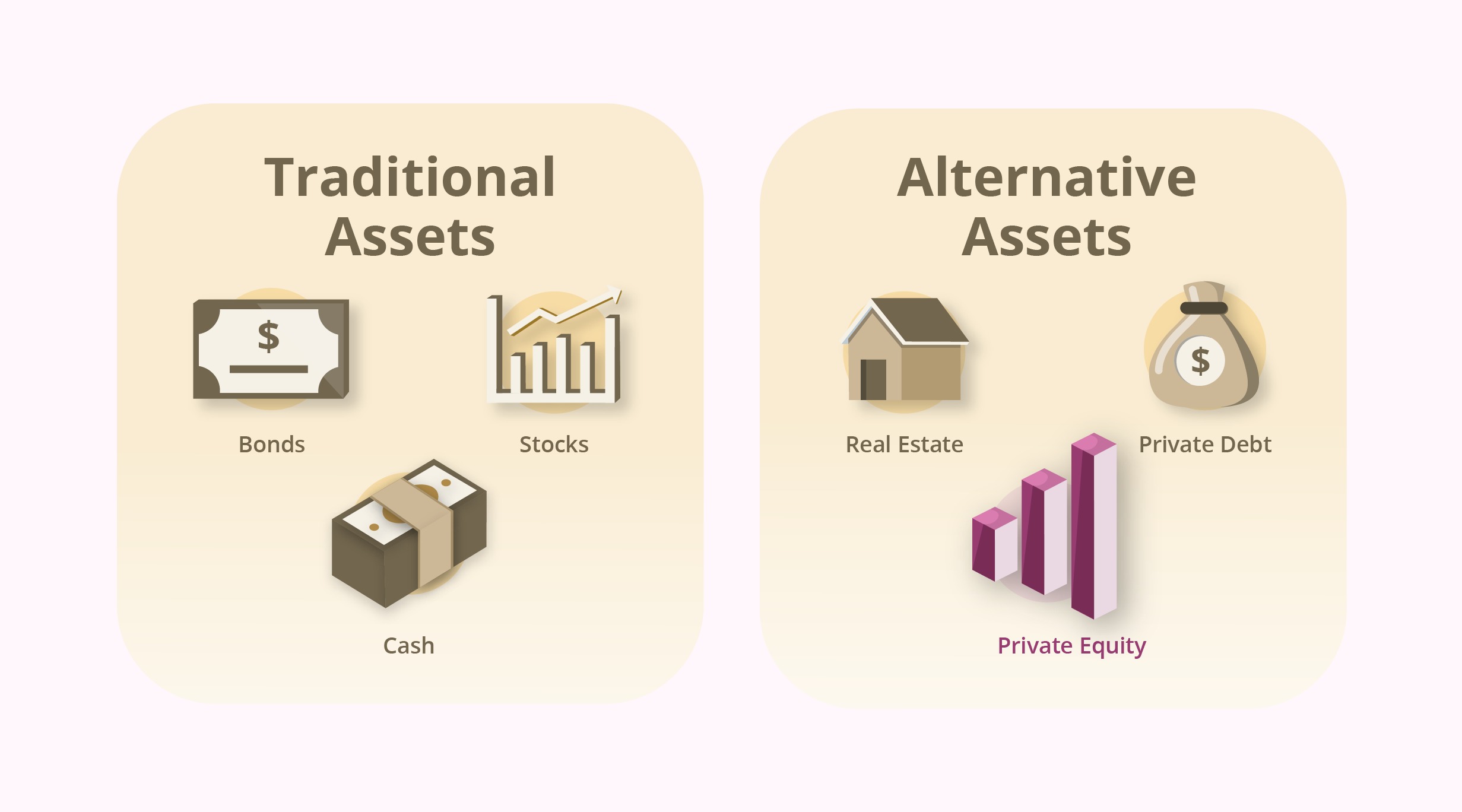

PE holds a unique place in the investment landscape, distinctly set apart from traditional asset classes. Traditional assets, forming the bedrock of most investment portfolios, include well-established options like equities, bonds and cash. These are known for their liquidity, historical performance data and regulatory oversight.

On the other hand, alternative asset classes encompass a range of investments that diverge from these conventional options. PE falls under this category, offering investors a different path to potentially augment growth and hedge against market volatility. Unlike traditional assets, alternative investments like PE often require specialised knowledge and come with a different risk-reward profile. They are sought for their potential to diversify portfolios and their typically lower correlation with standard market movements.

Who Invests In Private Equity?

PE investing is traditionally dominated by institutional investors, which includes banks, sovereign wealth funds, pension funds, university endowments, and insurance companies. Family offices have also increased their investments into PE. These groups of investors are typically characterised by a high degree of financial sophistication, with the necessary resources and expertise to commit to the longer investment horizons that PE requires, distinguishing it from the more liquid public markets. Increasingly, however, recent trends have started to open avenues for retail investors to participate in PE, democratising access to this asset class.

How Does One Access Private Equity Investment Opportunities?

Accessing PE investment opportunities has traditionally been limited to institutions and high-net-worth individuals due to the exclusivity of most PE funds. However, the landscape is evolving with the introduction of innovative financial platforms and products that make PE more accessible to a wider audience. New avenues include fund of funds, which aggregate investments from various individuals to participate in PE funds, and publicly traded PE firms such as Blackstone (NYSE: BX) and Apollo Global Management (NYSE: APO). Additionally, digital platforms are now offering access to PE with lower minimum investments for accredited investors. Despite the emergence of these opportunities, it's important for potential investors to fully grasp the unique risks of PE to make well-informed investment decisions.

Read the next article to find out why investors have sought out PE.