Investor Education

Learn More

Why Do Investors Turn To Private Equity?

2 min read time

Private equity (“PE”) is a well-established part of the portfolios of many institutional investors and increasingly, it is also being allocated to the portfolios of accredited investors. We examine two main reasons why investors add PE to their portfolios.

Why Do Investors Turn To PE?

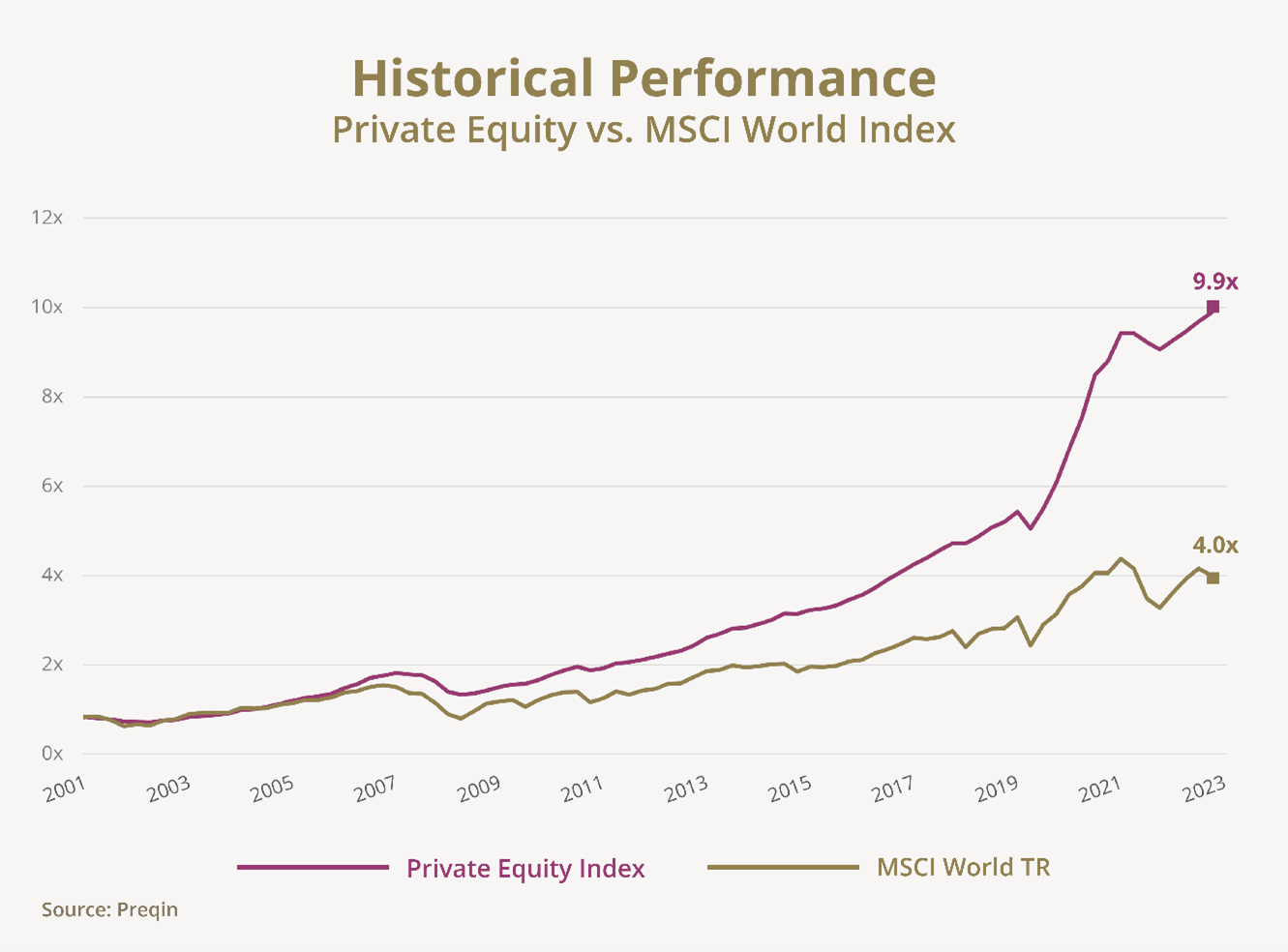

1. Historical Performance vs Public Markets

Exhibit 1

The allure of PE is rooted in its historical performance, which showcases a consistent potential for high returns. According to data from investment data company, Preqin, global PE funds have generated higher returns compared to the public-market equivalent MSCI World Index, which tracks the performance of developed market stocks (Exhibit 1). Industry data has continually demonstrated that PE outstrips public equity markets over extended investment periods. The outperformance of private equity over public equity stems from the active management approach of PE managers, which capitalises on their industry acumen to enhance the value of their holdings. PE investments come with their own set of risks as investing in PE can be unpredictable in terms of cash flow, and PE is also illiquid in nature and investors may face long lockup periods.

2. Diversification

Diversification is a foundational principle of investing, and PE could be an attractive addition to an investor's portfolio. By nature, PE investments are not directly correlated with the fluctuations of the stock or bond markets. Also, PE presents opportunities across a variety of sectors, stages of business development and geographic regions, offering a breadth of exposure that is difficult to replicate in public markets. From tech startups in Silicon Valley to manufacturing firms in emerging economies, PE taps into a diverse array of growth stories, further enhancing the diversification and potential resilience of an investment portfolio.

How Is The Private Equity Industry Trending?

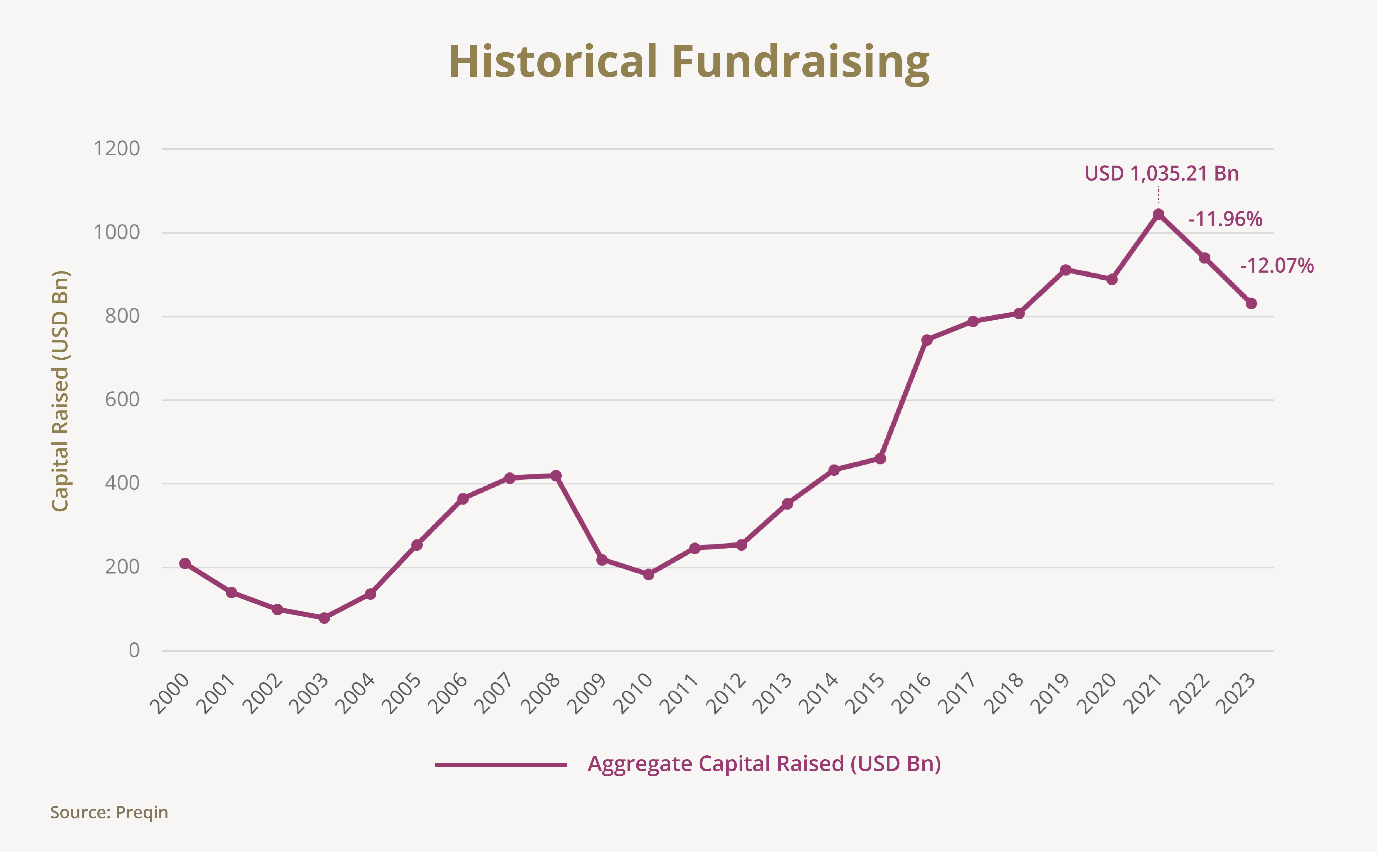

The global PE industry has experienced remarkable growth over the last two decades, culminating in a record-breaking 2021. This peak was driven by a robust fundraising environment, in which PE fund managers were successful in raising a historical high of USD 1 trillion in 2021 (Exhibit 2). Deal activity surged, particularly as fund managers capitalised on favourable market conditions to liquidate mature investments.

Exhibit 2

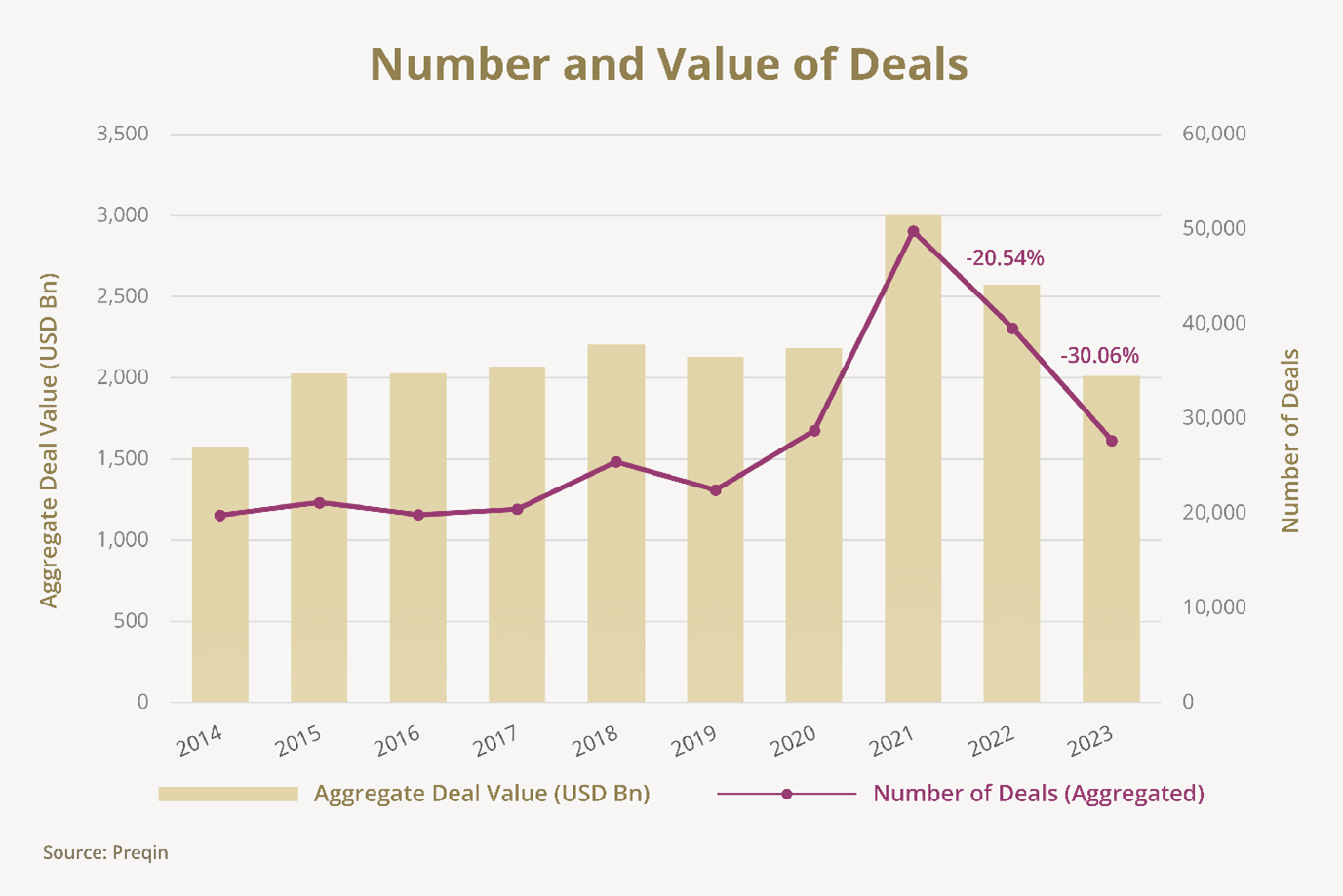

However, the upward trajectory in fundraising altered with the Federal Reserve’s decision to raise interest rates in June 2022. These rate hikes typically lead a cooling-off period for investments as borrowing costs rise and investors become more cautious. The reverberations were felt across the PE industry, with noticeable contractions in amount of capital raised (Exhibit 2). As we progressed into 2023, the global economic landscape, faced with a slowdown in growth, inflationary pressures and geopolitical uncertainties, continued to impact the PE sector. Investors, now more risk-averse, scaled back their activities, leading to a downturn in both the number and value of PE deals (Exhibit 3).

Exhibit 3

Despite the recent activity declines, the PE industry is expected to navigate these challenges effectively as it did with previous economic shifts, and continue to evolve and innovate.

In our next article, we will delve into the Risks and Considerations of PE Investing, providing insights into key factors one should be aware of when assessing PE investment opportunities.