Azalea hosted Azalea Investor Conference 2024 in July and we were honoured to have more than 200 guests, comprising institutional investors, family offices and our private banking and industry partners.

Back to top

Broadening Access to Private Equity: Azalea’s Story

The conference started with an opening address by our Chief Executive Officer, Ms Margaret Lui. Margaret highlighted the successful journey of Azalea’s flagship Astrea and Altrium platforms in fulfilling our mandate to make private equity accessible to a broader group of investors. Margaret also set the stage by emphasising how private equity is an attractive asset class to navigate the volatile investment environment.

Back to top

A Fireside Chat with Mr Dilhan Pillay Sandrasegara: Building Resilience in an Uncertain World

Our keynote speaker Mr Dilhan Pillay Sandrasegara, Executive Director and Chief Executive Officer of Temasek Holdings and Temasek International, delivered a highly anticipated fireside chat with Ms Margaret Lui. We thank Dilhan for sharing his wealth of experience and insights on how we can build resilience in an uncertain world.

Navigating Geopolitics and What It Means for Global Investors

Mr Pierce Scranton, Managing Director of Institutional Relations and Deputy Head of North America at Temasek International, spoke about geopolitical trends and how they affect the global investment landscape. His perspectives on US politics, especially in an election year, were especially helpful in contextualising the rest of our discussions around forces which shape interconnected global markets.

Back to top

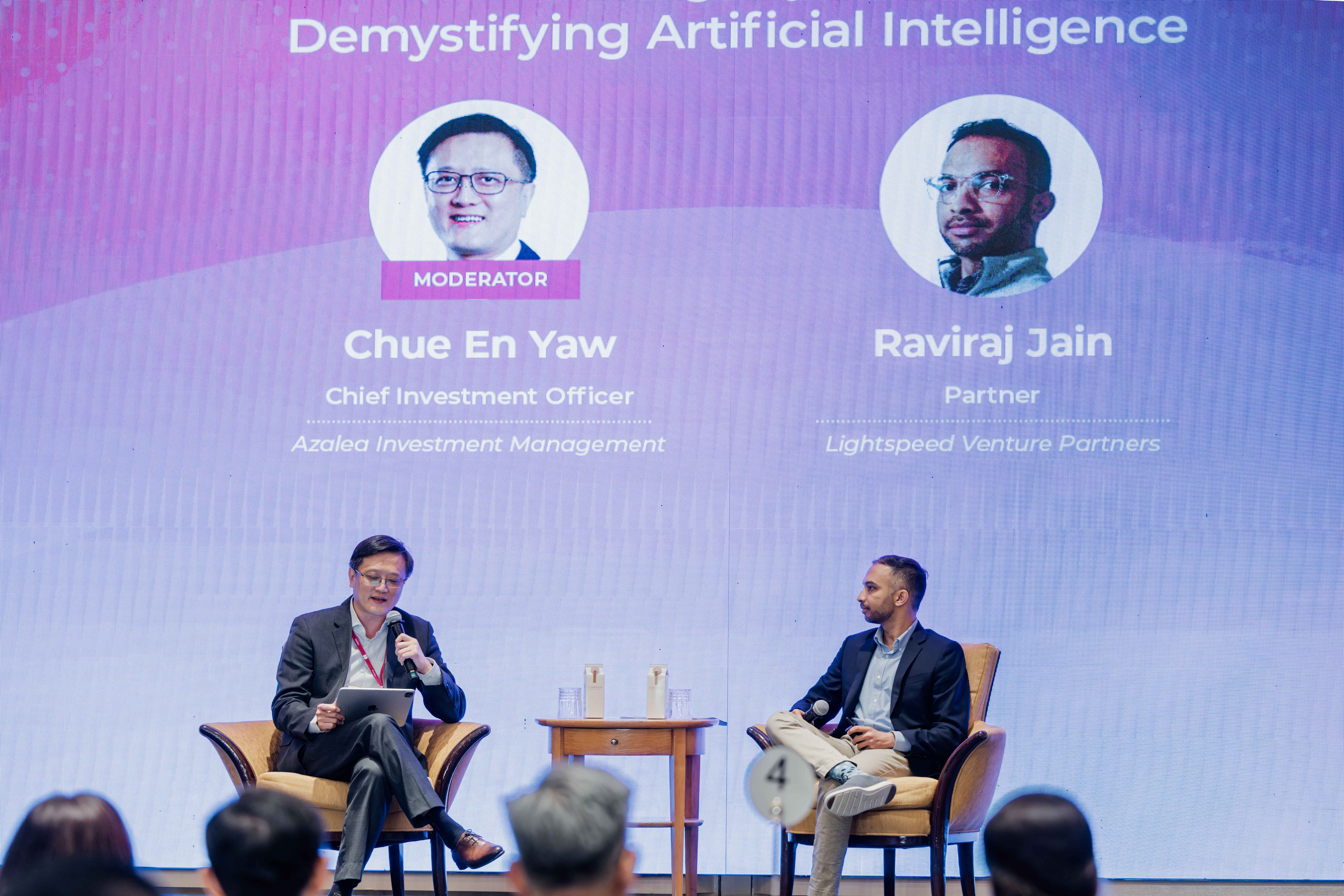

Demystifying Artificial Intelligence

Next, we dived into the transformative trends of Artificial Intelligence (AI) with Mr Raviraj Jain, Partner at Lightspeed Venture Partners — a multi-stage venture capital firm with extensive experience investing in AI. Raviraj covered important themes on investing in the AI and technology space, both in products and companies. Moderated by Mr Chue En Yaw, our Chief Investment Officer, the session helped to strip away the layers of ambiguity that often cloud our understanding of AI, and allowed us to visualise how AI will continue to transform the world we live in.

Finding Growth in the Current Landscape

Following which, we zoomed in on investment strategies of our PE fund managers, with a focus on growth investing. Ms Jacqueline Hawwa, Partner at TPG Growth which targets earlier-stage and high-growth companies, highlighted TPG’s investments across sectors based on market dynamics and their prudent approach to tech investing across market cycles. Mr Diwakar Chada, Managing Director of Investments at Azalea, moderated the Q&A segment where we discussed opportunities and challenges that Jacqueline foresees in the growth investing landscape.

Back to top

Driving Capital to Sustainable Solutions

After which, we segued into two panel discussions. The first panel featured Mr En Lee, Managing Director and Head of Sustainable and Impact Investments in Asia at LGT, and Mr Eric Lim, Chief Sustainability Officer at the United Overseas Bank. Both panellists are instrumental in steering their firms’ pursuits to drive capital to sustainable solutions. In conversation with moderator, Ms Alisa Chhoa, Managing Director, General Counsel and Chief Compliance Officer at Azalea, the panellists provided valuable insights on industry trends and regulatory developments around sustainability and emphasised how an ecosystem approach is critical for achieving systemic change.

Optimising Your Allocation to Private Markets

Our next panel comprised Limited Partners at different stages of their journey in investing in private markets – Mr Alvin Goh, Chief Investment Officer at Finexis Asset Management, Ms Lim Li Ying, Deputy Chief Executive Officer and Chief Investment Officer at Singapore Labour Foundation, and Ms Winnie Hau, Investment Director from The University of Hong Kong. Moderated by Ms Tang Hsiao Ching, Managing Director of Investor Solutions and Marketing team at Azalea, the panellists shared their perspectives of asset allocation in private markets. Indeed, there is no one-size-fits-all solution and each investor should consider their unique risk/return profiles and resources when it comes to allocation to private markets.

Back to top

Conclusion

We would like to extend our heartfelt appreciation to all speakers for taking the time to share their insights, and our guests for their participation. We are heartened by the support given to Azalea and it was indeed a privilege to have built valuable connections at the conference. We look forward to seeing you at the next event!

Back to top