This article delves into the structure and economics of Private Equity (PE) Funds, a key segment in the global investment landscape. We explore the framework, roles of key stakeholders, fee structures and trends in PE funds.

Basic Framework of PE Funds

A typical PE fund operates over a 10 to 12-year lifecycle, encompassing the fundraising, investment, management and exit phases. At its core, Limited Partners (LPs) commit capital, which General Partners (GPs) deploy into investments. Profits are generated through asset management and divestment, with returns distributed to LPs while GPs receive their carried interest if PE funds meet the returns hurdle. This structure is designed to align the interests of GPs and LPs while maximising investment returns.

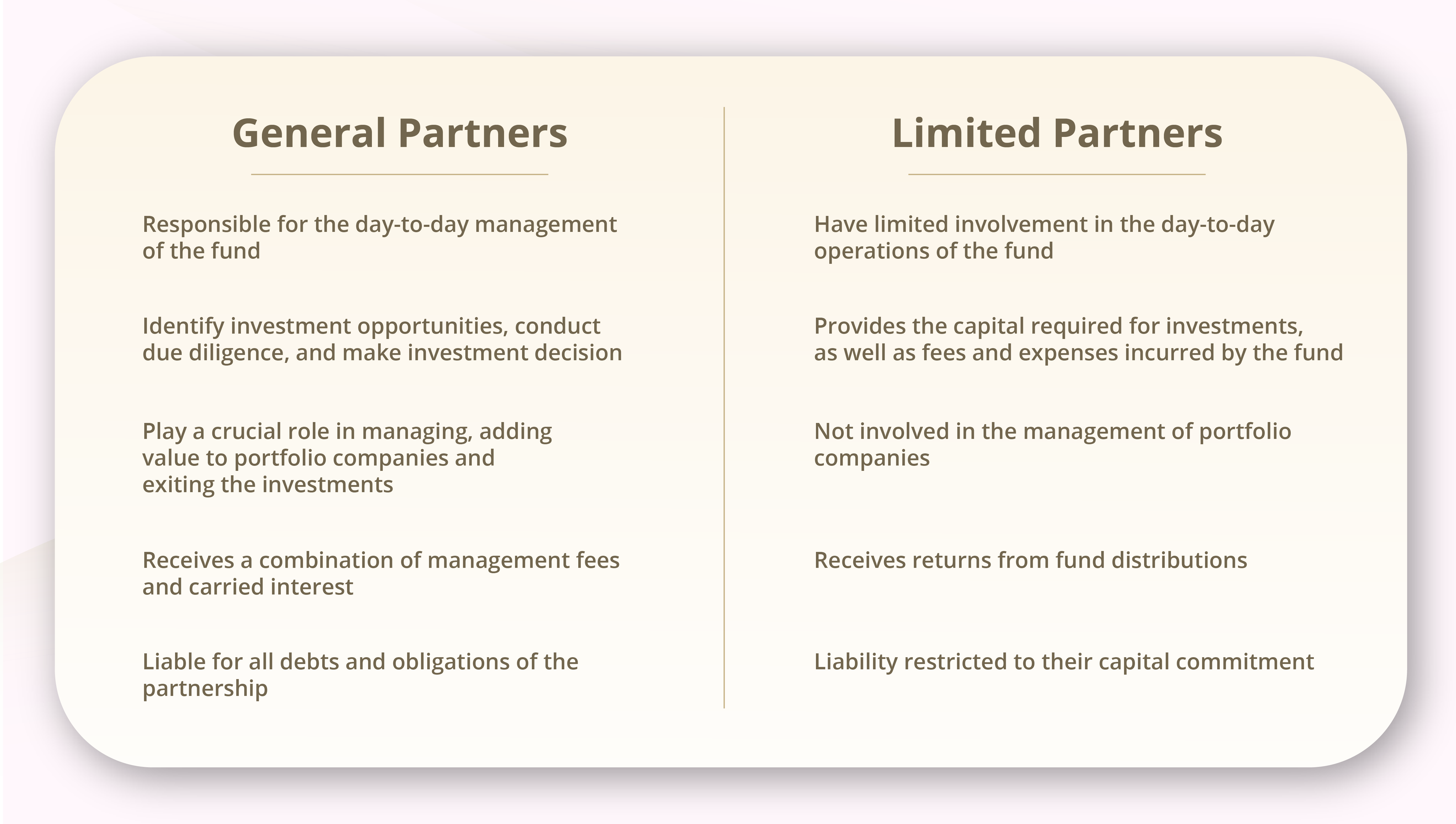

In-Depth Look at General Partners (GPs) and Limited Partners (LPs)

GPs are responsible for the day-to-day management of the fund. They identify investment opportunities, conduct due diligence, and make investment decisions. GPs also play a crucial role in managing, adding value to portfolio companies and exiting the investments. Their compensation is typically a combination of management fees and carried interest, aligning their financial interests with the fund's performance.

LPs, on the other hand, provide the capital required for investments. They are typically institutional investors, such as private banks, insurance companies, family offices or high-net-worth individuals. LPs have limited liability, restricted to their capital commitment. They rely on GPs to manage the investments effectively and have limited involvement in the day-to-day operations of the fund.

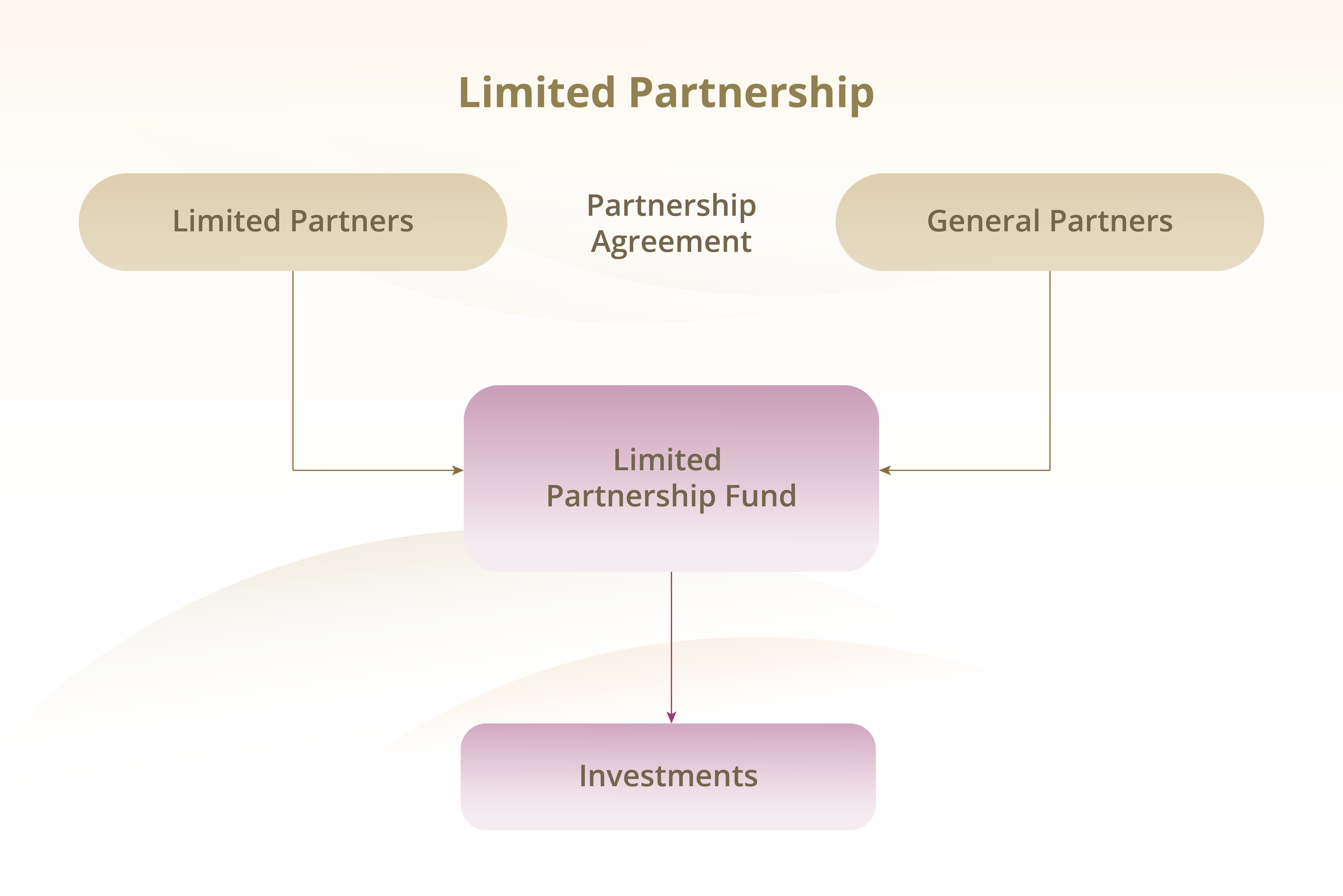

The relationship between GPs and LPs is governed by a legally binding contract that establishes the terms and conditions of the applicable fund (such as a limited partnership agreement). Those terms and conditions would include the fund’s investment strategy, the rights and obligations of the LPs, how and when profits will be distributed amongst the partners, fees and expenses payable, and governance-related provisions, amongst others.

Fund Economics: Fee Structures and Returns

The economics of PE funds are anchored in their fee structures. They charge a management fee and performance fee, also known as carried interest.

Management fees are typically charged on a quarterly basis and calculated as a percentage of committed capital or assets under management (AUM) that is commonly around 2% per annum.

Carried interest represents a share of the profits earned by the fund, accruing to the GPs as a performance incentive. Typically, GPs receive 20% of the profits, but only after returning the initial capital contributed by the LPs and achieving a predetermined rate of return, known as the hurdle rate. This structure ensures that GPs are motivated to maximize returns for the investors.

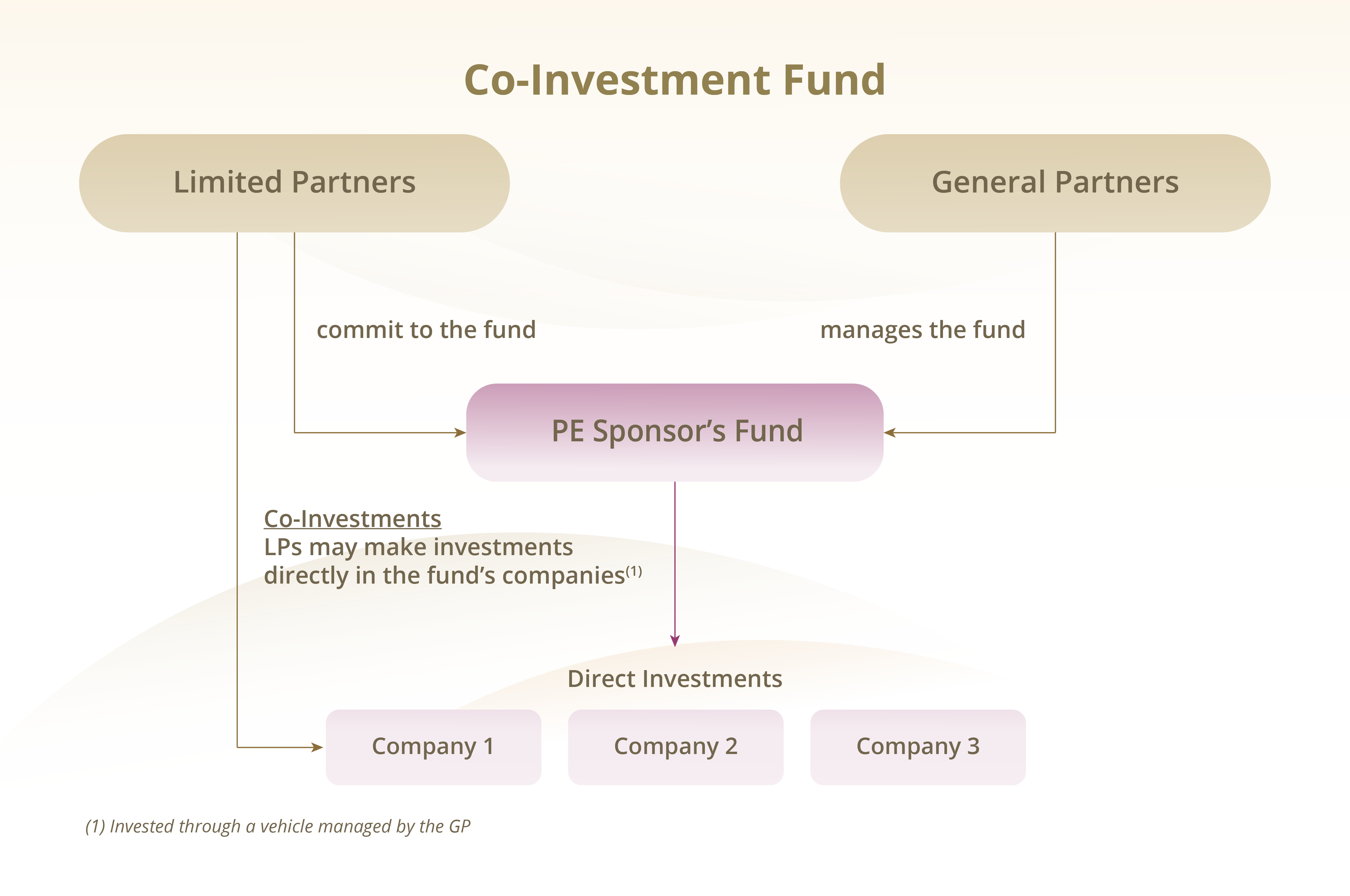

Fee structures can vary based on the type of fund. For instance, evergreen funds or co-investment funds might have different fee arrangements, reflecting their unique investment strategies and risk profiles.

Types of PE Fund Structures

Private Equity (PE) funds can adopt various structures to meet specific investment strategies, regulatory requirements and investor preferences. Here are some of the common types of PE fund structures:

1. Limited Partnership

Common in private equity, where limited partners, or investors, provide capital and have limited liability, and a general partner manages the fund. This structure is favoured for aligning interests between investors and managers and for the limited liability protection it offers to investors.

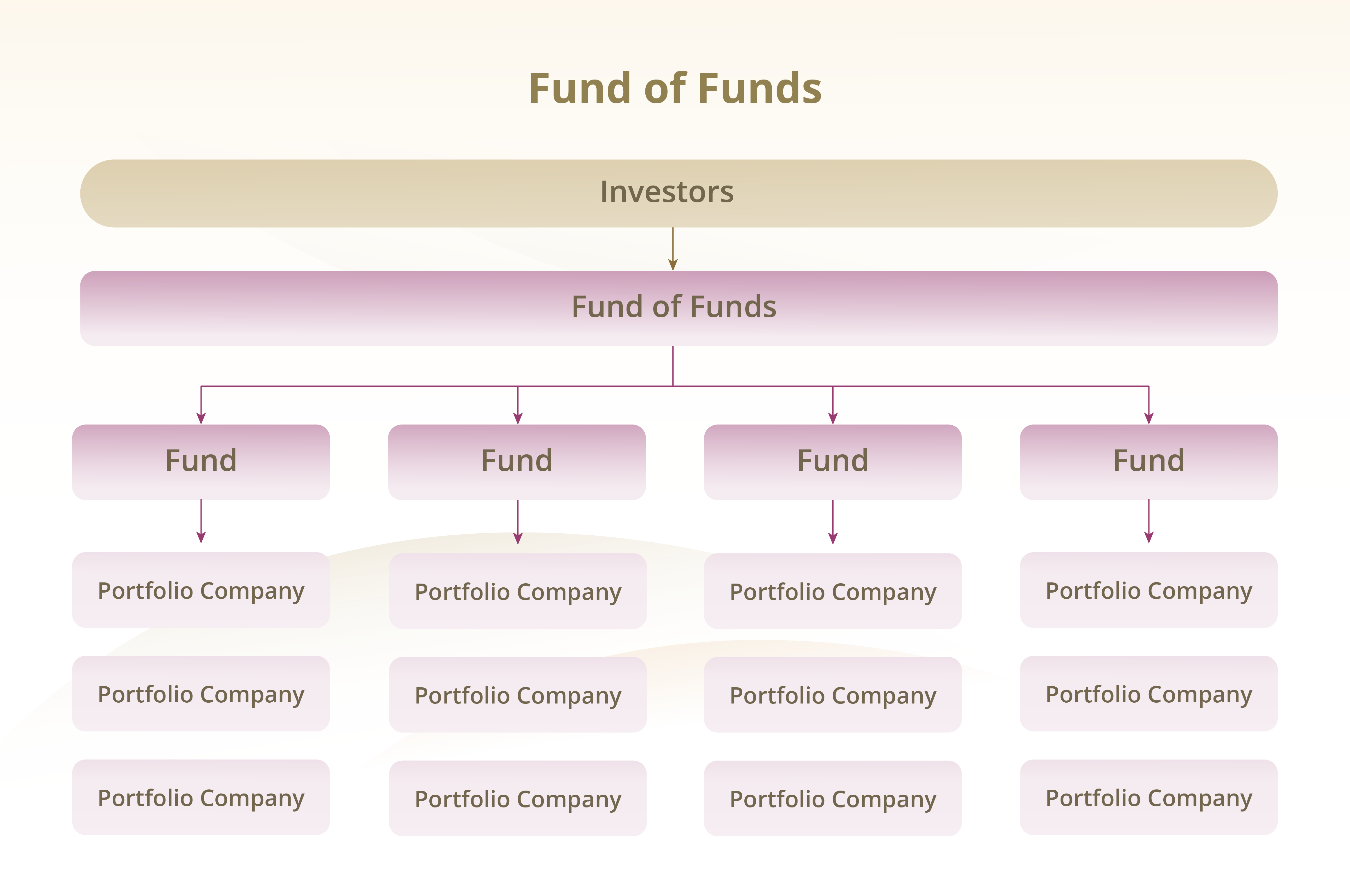

2. Fund of Funds (FoF)

These funds invest in a portfolio of other funds rather than investing directly in stocks, bonds or other securities. This allows investors to achieve diversification across different managers and strategies.

3. Co-Investment Fund

In a co-investment fund, investors are provided direct equity exposure at the portfolio company level typically with no fees and carry charged by the underlying GPs.

4. Evergreen Funds

These funds do not have a fixed lifespan and operate on a perpetual basis. Capital can be raised, and investments can be made indefinitely. Investors often have the ability to enter or exit the fund at predetermined intervals, providing more flexibility compared to traditional closed-end structures.

Wrapping Up

The interplay between GPs and LPs, shaped by structured economic incentives and legal agreements, underscores the essence of PE funds. Diverse in structure, from Limited Partnerships to models like Evergreen and Co-Investment Funds, they address a wide range of investment strategies and investor needs. In the next article of the series, we dive deeper into the lifecycle of a PE fund.