At Astrea Investor Day 2025, Margaret Lui, Azalea’s Chief Executive Officer and Chue En Yaw, Chief Investment Officer had an insightful conversation on Astrea private equity (“PE”) bonds.

Back to top

Azalea’s Beginnings and the History of Astrea

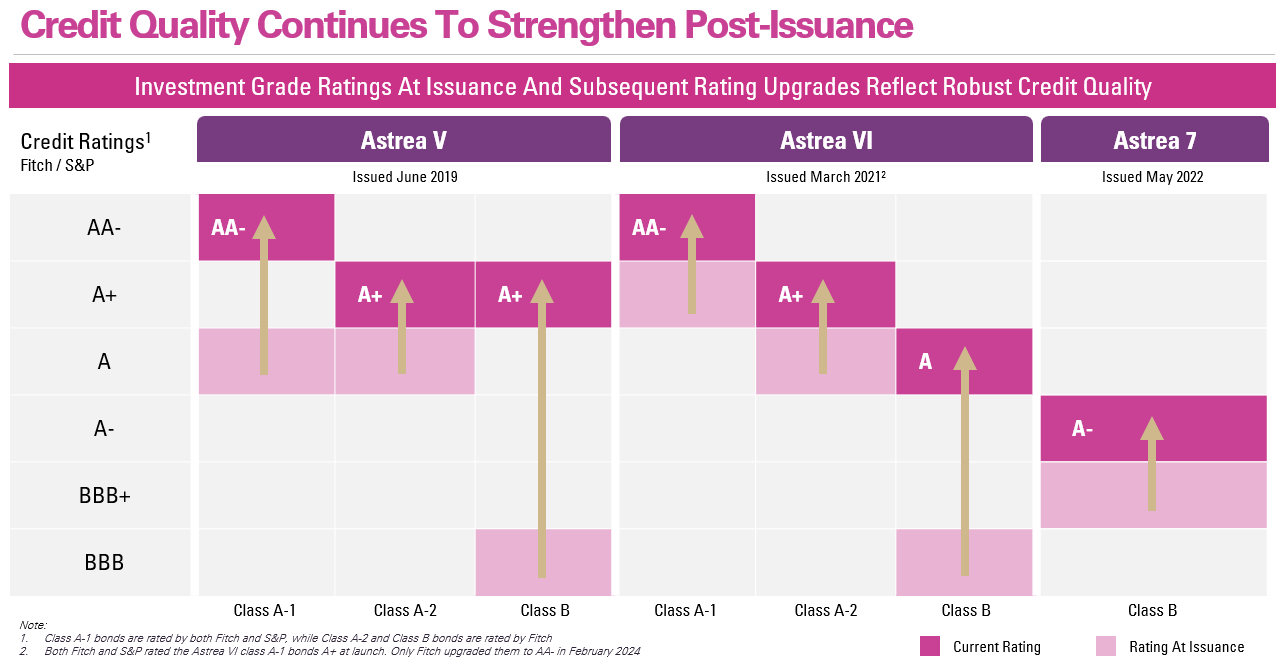

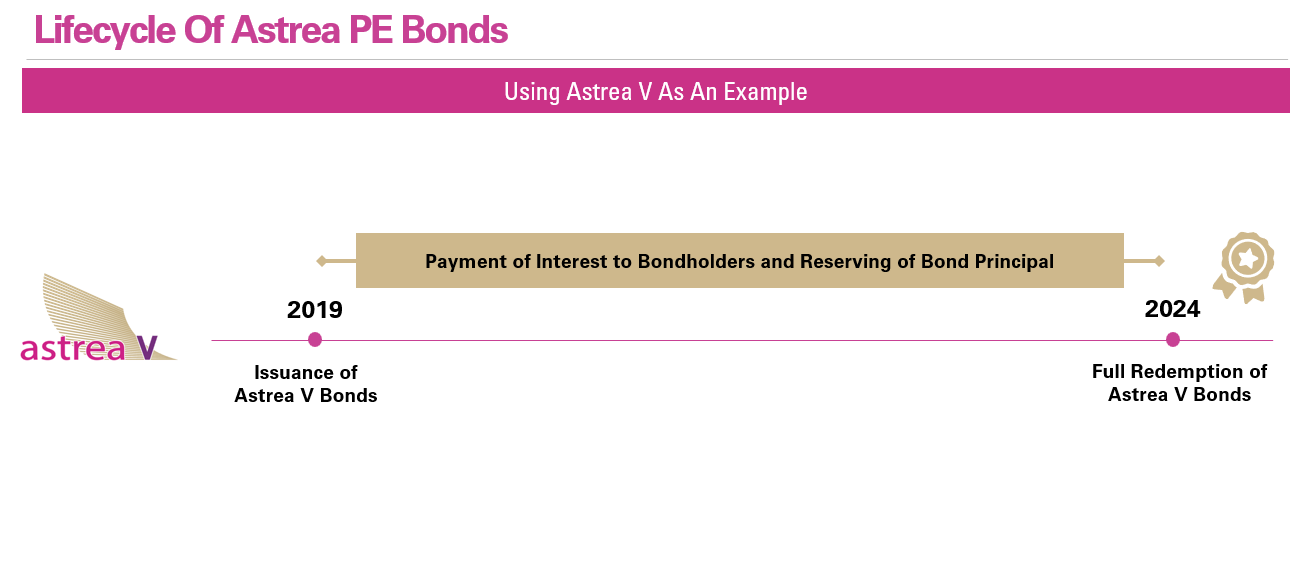

They kicked off the conversation with a recap on Azalea’s beginnings and the history of Astrea. Azalea was set up in 2015 by Temasek with the mission of making private equity more accessible to a wider group of investors. Astrea PE bonds marked the first step of a phased approach towards making PE available to retail investors. It provided retail investors with an opportunity to invest in an investment-grade rated fixed income product which is backed by cashflows from PE funds.

Building upon that foundation, Azalea launched Altrium PE Fund in 2019. Since then, Azalea has developed a suite of equity products including Altrium PE Fund, Altrium Co-Invest Fund, Altrium Sustainability Fund and Altrium Growth Fund to meet different risk and return preferences of accredited investors.

Back to top

Personal Asset Allocation & Fixed Income Investing

When discussing asset allocation for one’s investment portfolio, Margaret highlighted the importance of investing in a diversified portfolio of safer assets such as fixed income, together with higher returning and higher risk growth assets like equities. She also shared that the right balance would depend on each individual’s financial goals and risk tolerance.

Key Features of Astrea PE Bonds

En Yaw continued by outlining some key features of Astrea PE Bonds:

- Lower risk profile compared to equities;

- Regular coupons paid every six months with a fixed maturity; and

- Rated by a reputable international agency to provide additional comfort to retail investors.

Margaret and En Yaw also took the opportunity to address some common questions that investors have on Astrea bonds.

1. Pricing of Astrea PE Bond

On how Azalea determines the interest rate for each Astrea PE bond, Margaret provided insights into the bookbuilding process, explaining how institutional investors play a key role in determining the bond pricing before it is offered to retail investors.

2. US Dollar Tranche for Retail Investors

En Yaw highlighted how investors have been able to subscribe to a USD-denominated tranche since Astrea 7, which provides more investment options for retail investors since many have become more accustomed to having USD exposure.

En Yaw also stressed that foreign exchange risk is a factor that retail investors should consider when investing in the USD tranche, as investments may be subject to exchange rate fluctuations if their investment currency base is not in USD.

3. Allocation Policy

Margaret explained the Astrea bond allocation process, sharing that Azalea's goal has always been to allocate to as many investors as possible.

Given the strong demand for Astrea bonds, Margaret highlighted that the allocation process ensures that smaller investors will get some allocation for the bonds even if it is not to the full amount they applied for. At higher amounts, applicants would have to be balloted and were allotted only a portion of their applications. Interested parties may refer to the balloting table published at the end of every issuance for more details.

Back to top

Leadership Succession and Azalea’s Future

En Yaw will succeed Margaret as CEO on 1 April 2025, while retaining his CIO responsibilities.

On sharing his vision for Azalea, En Yaw highlighted that in addition to being a regular issuer of Astrea PE bonds, the team will look for new ways to innovate to expand retail offerings and enhance investor access to PE.

Watch the full replay of the fireside chat here: