Investor Education

Learn More

Private Equity Guide in 3 Minutes

3 min read time

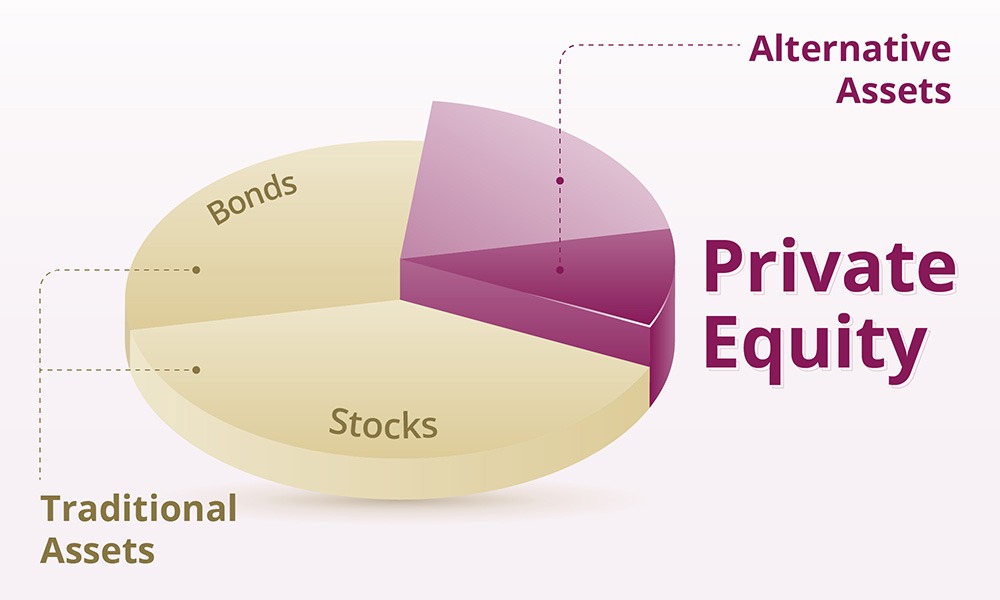

In the diverse landscape of the investment assets, Private Equity (“PE”) stands out as a distinct and compelling avenue for those looking to diversify their portfolios and potentially achieve higher returns.

But what exactly is PE?

Definition Of Private Equity

PE is a form of investment where investors directly invest in private companies or buy out public companies to take them private. Unlike publicly traded stocks, PE investments are not listed on stock exchanges.

For a comprehensive understanding, explore the first article of our PE deep dive series to kickstart your educational journey into the world of PE.

Private Equity Industry Overview

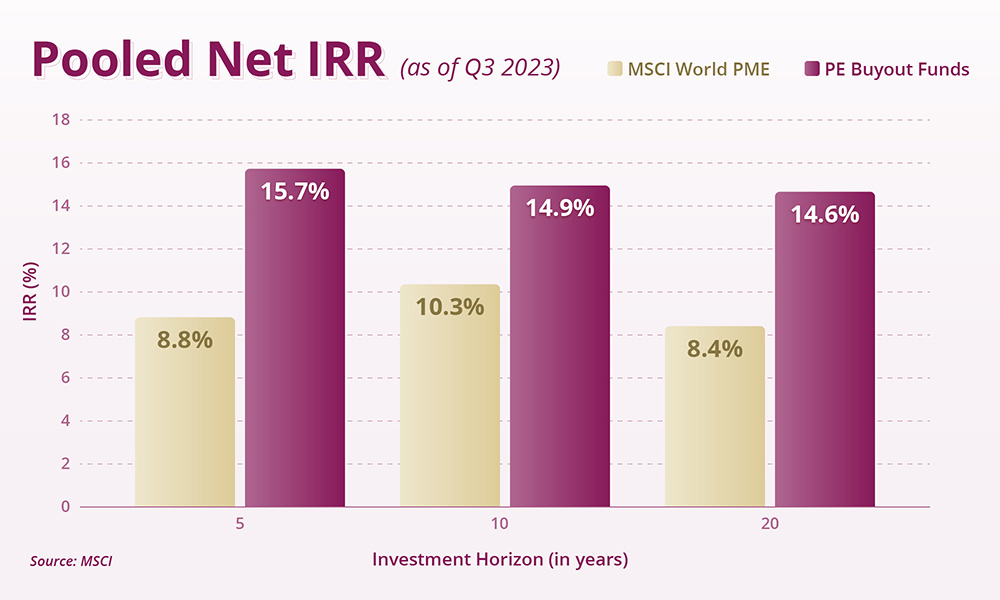

The PE industry has experienced rapid growth over recent years, expanding its influence across global markets. This surge is driven by increasing investor interest, attracted by the potential for higher returns and the industry’s ability to drive transformation in portfolio companies. In particular, PE buyout funds have consistently outperformed public markets over various investment periods, as evidenced by the higher pooled net Internal Rate of Return ("IRR") across 5-, 10-, and 20- year periods when compared to the MSCI World Public Market Equivalent ("PME") as of Q3 2023. PE now commands a significant portion of the investment landscape, playing a pivotal role in shaping business growth and innovation worldwide.

- PE industry’s assets under management (AUM) has enjoyed significant growth of approximately 12.7% per annum since 2000¹

- Since 2000, U.S.-focused PE Funds have represented at least half of global PE AUM¹ and is widely considered the largest and most developed market for PE Fund investing

1Preqin, March 2024

How Private Equity Works

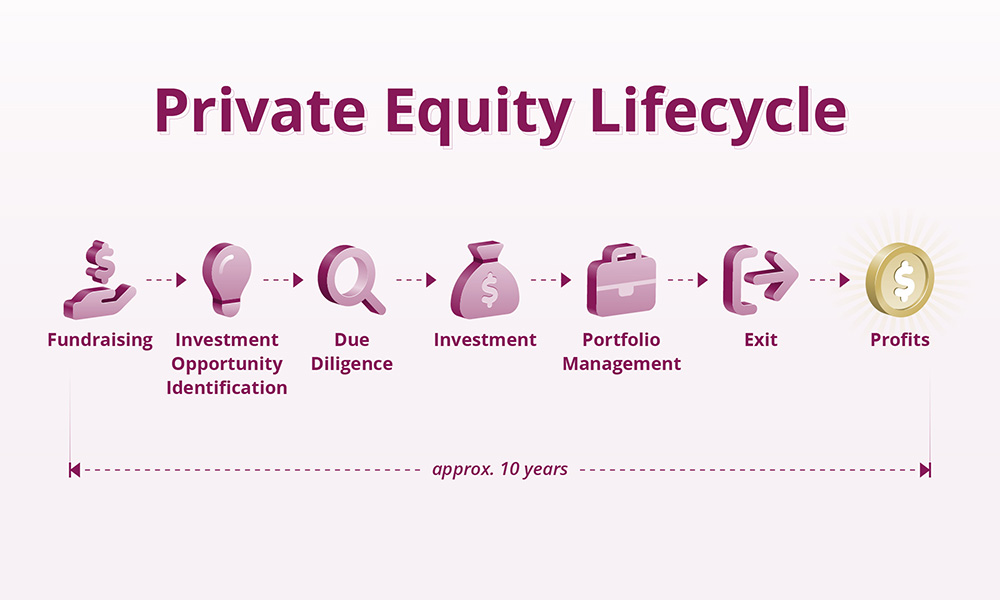

The PE process involves identifying potential investment opportunities, acquiring stakes in companies, actively managing these investments to enhance their value, and finally, exiting these investments through a sale or IPO to realise a profit.

Types Of Private Equity Investments

| Type of PE Investments | Description |

| Buyout | This is the strategy of acquiring a controlling interest in a company, often to take it private and restructure it for profitability. |

| Growth Equity | This involves investing in established companies to help them expand or restructure without taking control away. |

| Venture Capital | Venture capital is funding given to early-stage, high-potential startups in exchange for equity. |

| Turnaround Strategy | This is a plan to revive a struggling company by improving its operational, financial, and strategic positioning. |

| Fund of Funds | A fund of funds invests in a portfolio of various private equity funds rather than directly investing in companies. |

| Secondary Funds | Secondary funds buy existing investments in private companies or funds from other investors, rather than investing directly. |

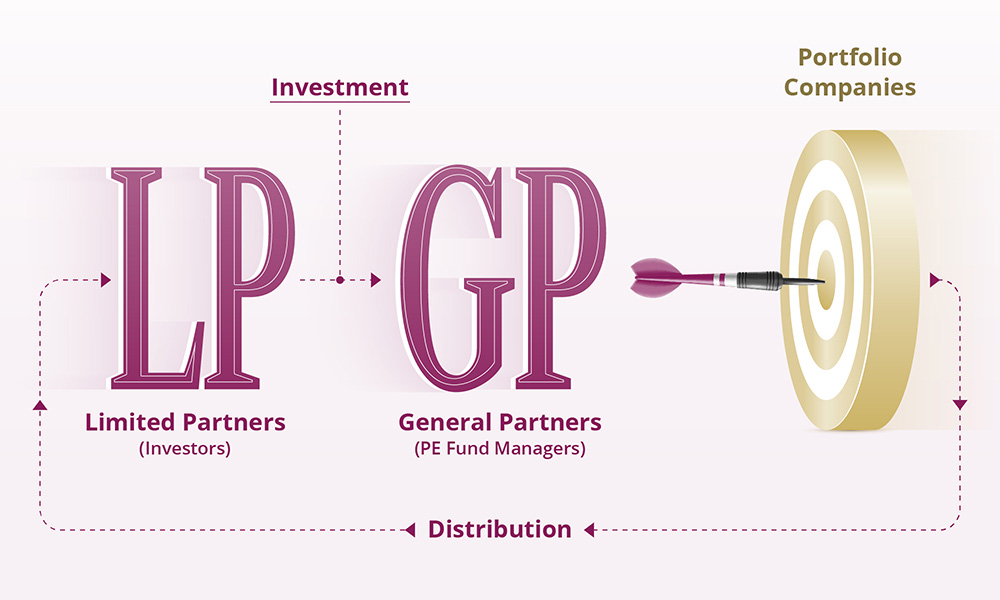

Key Players In Private Equity

Key players in PE include General Partners ("GPs") who manage the PE funds, Limited Partners ("LPs") who invest in these funds, and portfolio companies that are the investment targets. The relationship between General Partners and Limited Partners, shaped by economic incentives and legal agreements, underscores the essence of these funds.

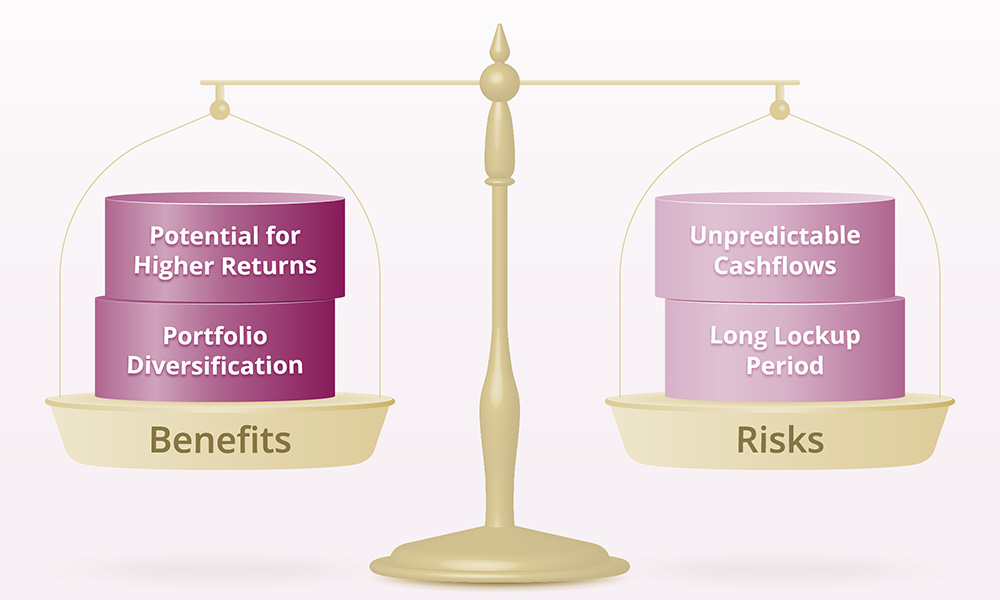

Benefits And Risks Of Private Equity

PE offers several benefits, including the potential for higher returns, which are potentially higher than public markets. This is partly due to PE firms' active management strategies and their ability to tap into exclusive opportunities that are not accessible in public markets. Furthermore, PE serves as a good tool for portfolio diversification. Its performance is not directly correlated with the fluctuations of the stock market, and it spans a diverse range of sectors and industries.

On the flip side, PE investments come with their own set of risks. Investing in PE can be unpredictable in terms of cash flow and requires firm commitments, with penalties for not meeting these commitments. Another risk is their illiquid nature, meaning that these assets cannot be quickly sold or converted into cash. Investors in PE face long lockup periods, during which their capital is tied up and inaccessible, presenting a significant long-term commitment.

Read about why investors turn to PE and the risks considerations of PE in our deep-dive articles..

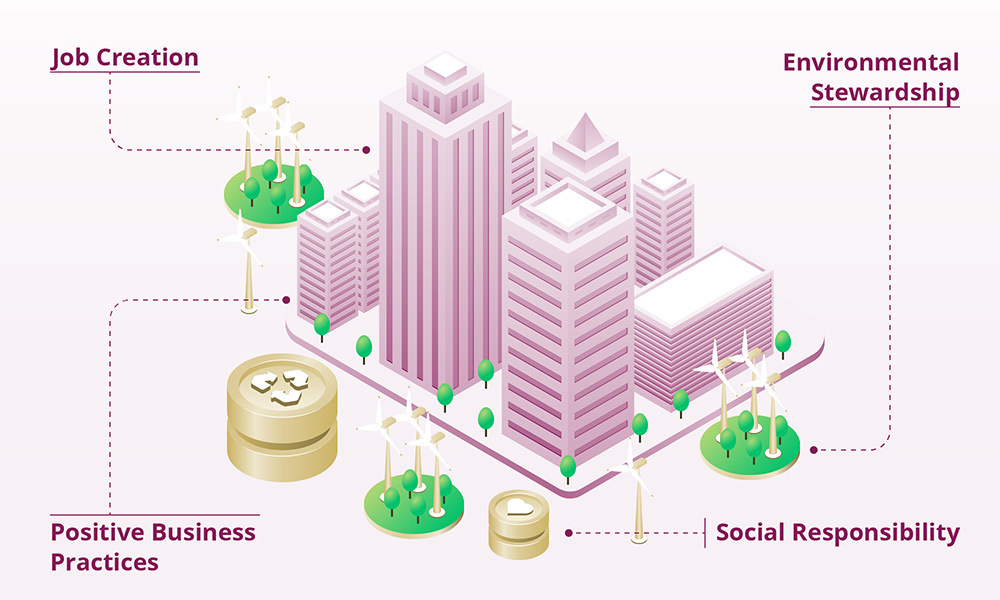

Impact Of Private Equity

PE plays a significant role in the economy by investing in and growing businesses, which can lead to job creation and economic development. Additionally, an increasing focus on sustainability investing by PE firms is contributing to environmental stewardship and social responsibility, driving positive changes in business practices and innovations in green technologies. PE firms bring expertise and resources to companies, helping them innovate and expand.

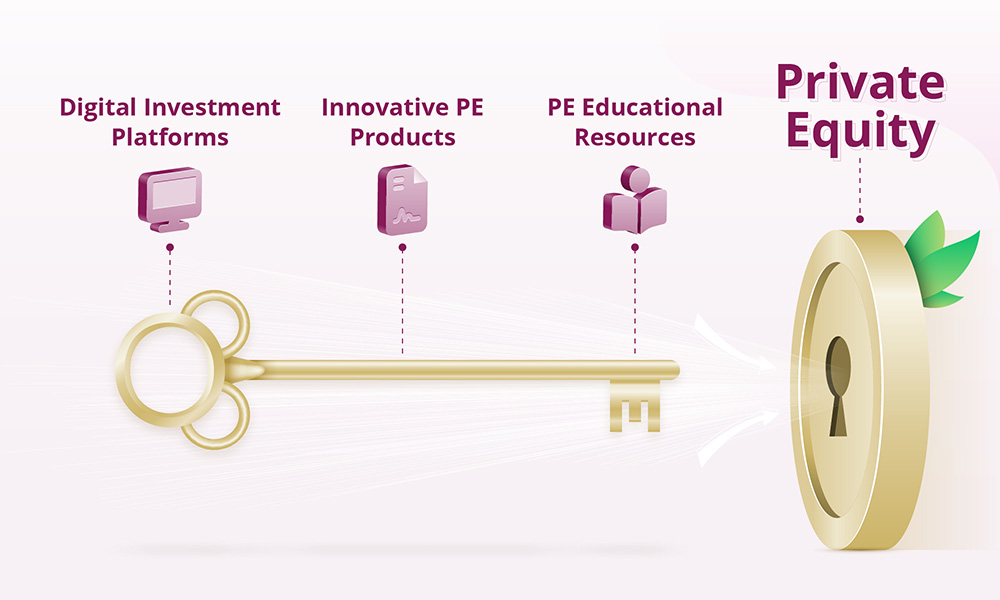

Why Is It Easier To Access PE Today?

- Growth of digital investment platforms has simplified the process of investing in PE and lowered the minimum investment thresholds for accredited investors.

- Innovative PE products, such as PE bonds targeted at retail investors, offer a more efficient way for investors to invest in PE.

- More educational resources about PE are available to investors today.