On 18 February 2025, Azalea hosted our annual Astrea Investor Day 2025, a forum for Astrea Private Equity (“PE”) bond investors to understand more about PE and the performance of the Astrea PE bonds.

Back to top

Azalea Overview

The webinar kicked off with a firm overview by Tricia Tan, Director, Investor Solutions & Marketing, who highlighted Azalea’s three-pronged role as Investor, Developer and Manager. Established by Temasek in 2015, Azalea has approximately US$11 billion in assets under management to date, and the Astrea platform has completed eight transactions and the Altrium platform has expanded to five PE funds.

Reflecting on the past year, Tricia shared several key milestones for both Astrea and Altrium platforms. Azalea issued Astrea 8 in July 2024 and successfully redeemed Astrea V PE bonds in December 2024. September 2024 also marked the final closings of Altrium Co-Invest Fund I and Altrium Growth Fund I for a combined US$480 million, both surpassing their respective target fund sizes of US$200 million each.

In January 2025, Azalea also marked a decade of broadening access to PE for a wider group of investors, and celebrated our 10th Anniversary with an appreciation dinner attended by investors, industry partners and staff.

Back to top

Market Update

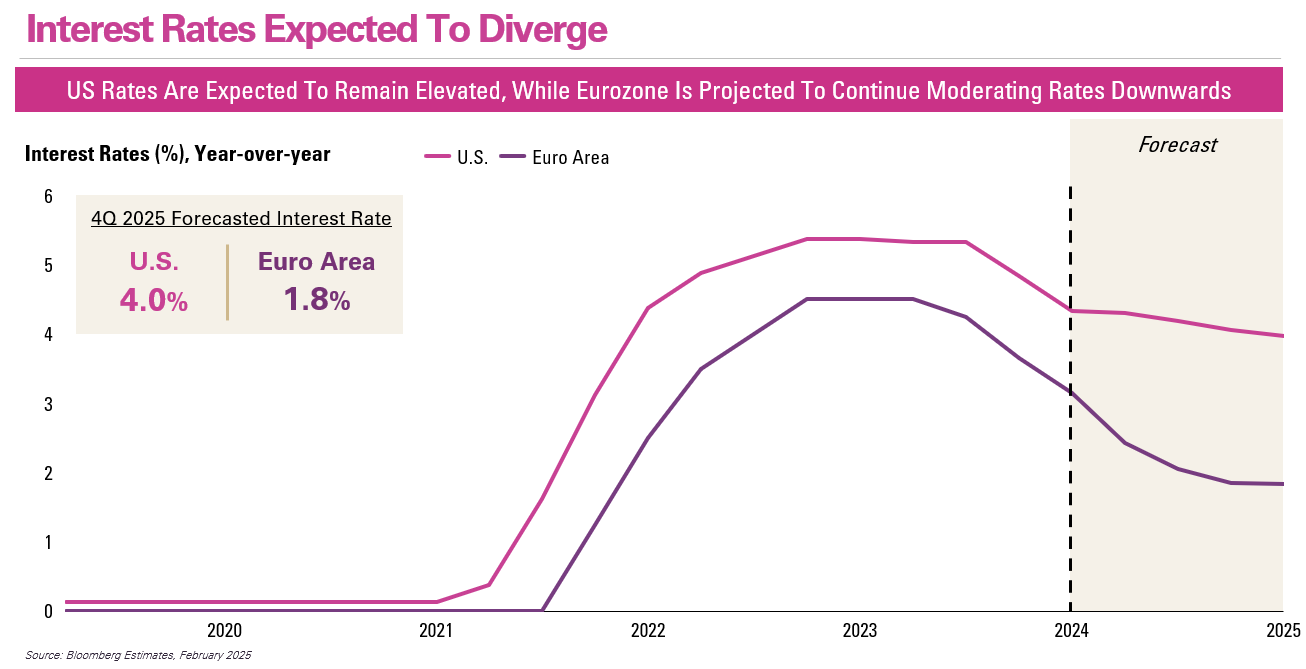

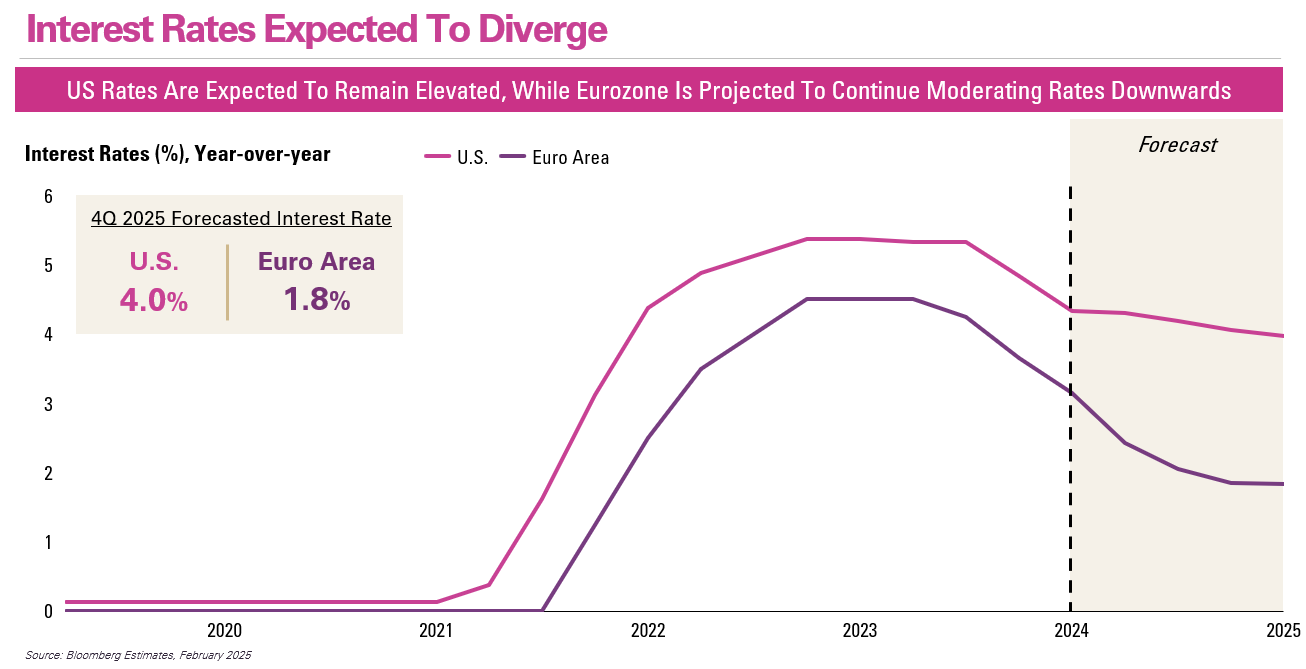

Justin Keh, Managing Director, Investments, highlighted several key market updates. He shared that global gross domestic product (“GDP”) growth remained stable in 2024, with continued economic growth expected in 2025 and 2026. He also spoke that U.S. and Eurozone interest rates were expected to diverge.

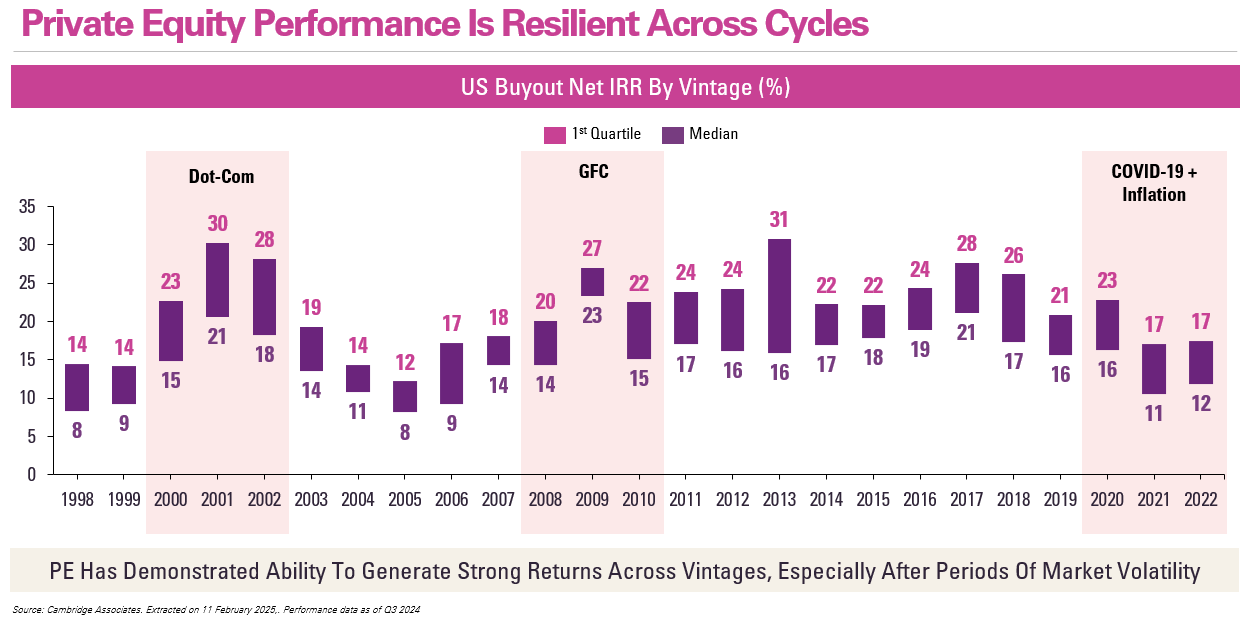

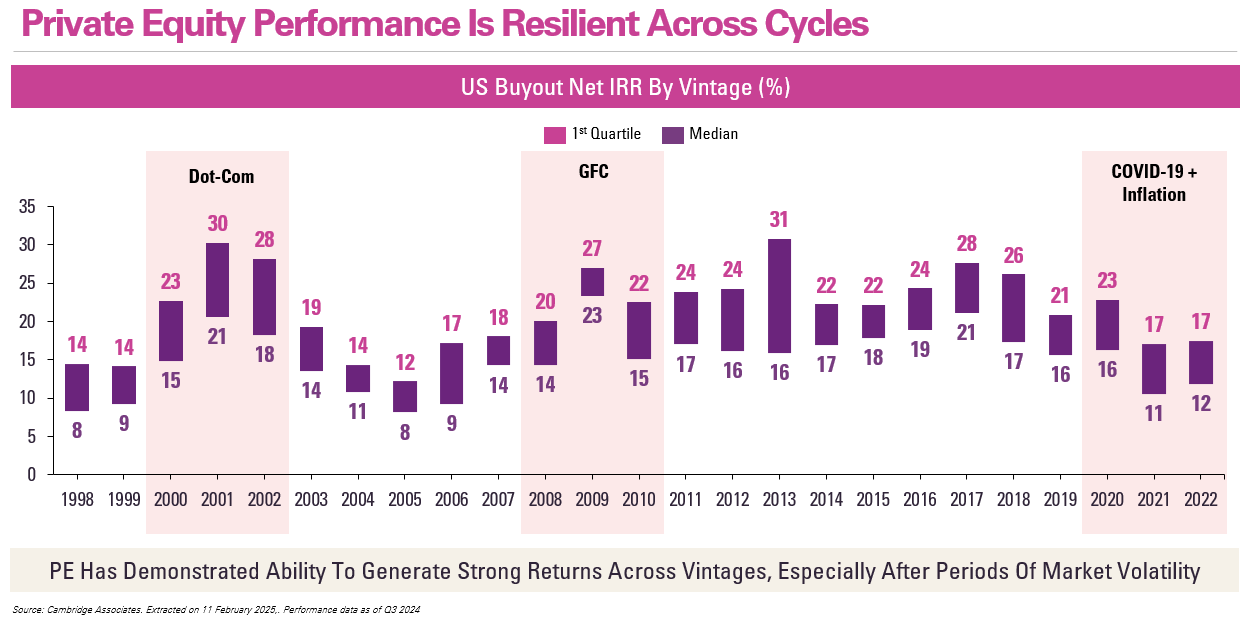

Justin also discussed Trump’s first weeks in office. Markets and economies continue to assess the implications of the new Administration’s executive orders and policy direction, while the PE industry evaluates their potential impact on business operations and growth strategies. He observed that despite challenges and uncertainty in the markets, PE as an asset class continued to be resilient across market cycles.

Back to top

Justin also shared updates on the performances of the various Astrea PE bonds which have held up amid challenging macroeconomic conditions.

- Since issuance, the Astrea V PE bonds enjoyed strong cash distributions of over US$1.5 billion since 2019, representing around 120% of the initial portfolio Net Asset Value (“NAV”). Underpinned by this strong generation of cash flows, the Astrea V bonds were fully redeemed in December 2024.

- The Astrea VI portfolio also enjoyed strong cash distributions totaling over US$1.1 billion and experienced fair value gains of US$432 million. Its Loan-to-Value (“LTV”) ratio also sits comfortably at 20.4%, well below the 50% maximum LTV ratio.

- Astrea 7 portfolio has reaped strong cash distributions of nearly US$800 million, around 41% of the starting portfolio NAV. It has also recovered from a slight decline, seeing fair value gains of US$57 million.

- Issued in July 2024, Astrea 8 portfolio has generated healthy cash distributions of over US$200 million, around 14% of the starting portfolio NAV. All the bonds continue to be rated investment grade.

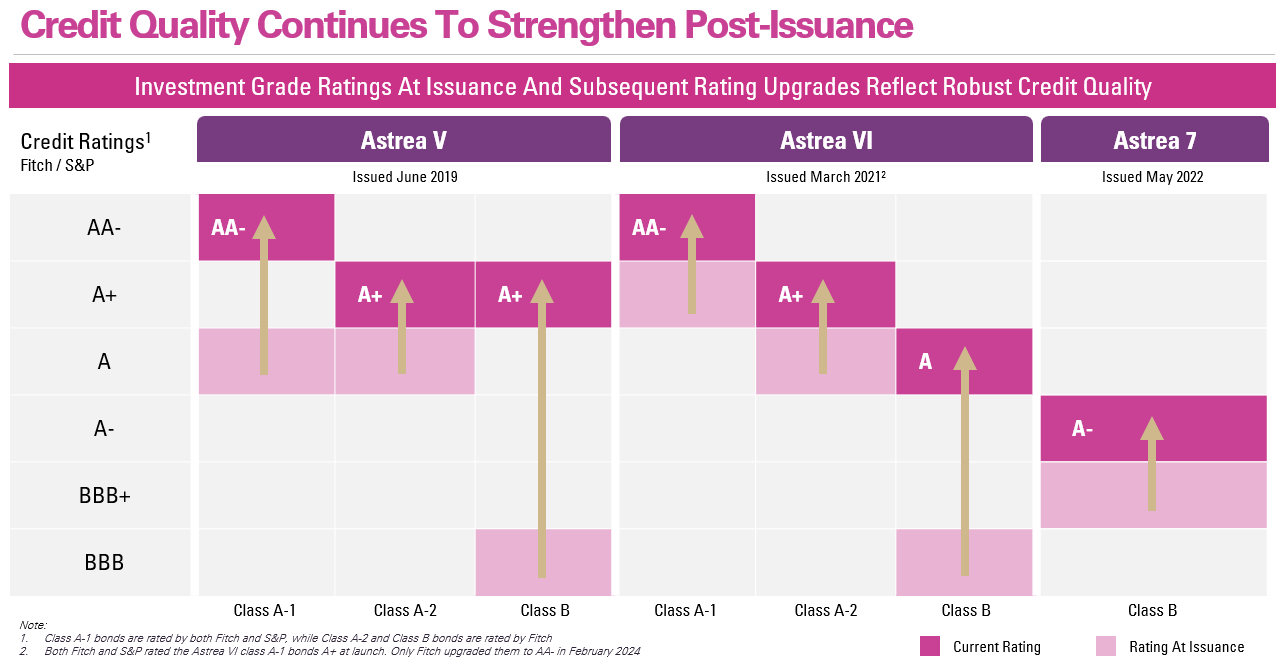

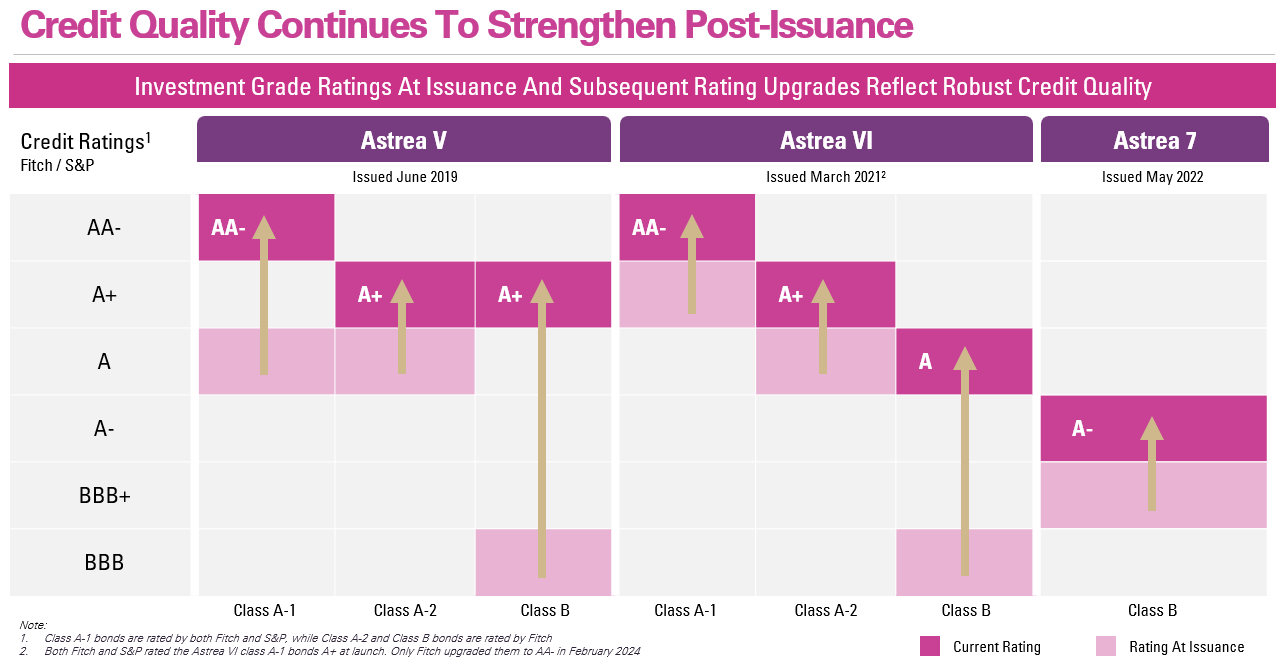

Justin highlighted the credit strength of the Astrea PE bond series which saw multiple credit rating upgrades over the years. He also shared that the Astrea portfolios continued to be cash generative, which helped to de-risk Astrea transactions progressively over time.

Back to top

Life Cycle of Astrea PE Bonds

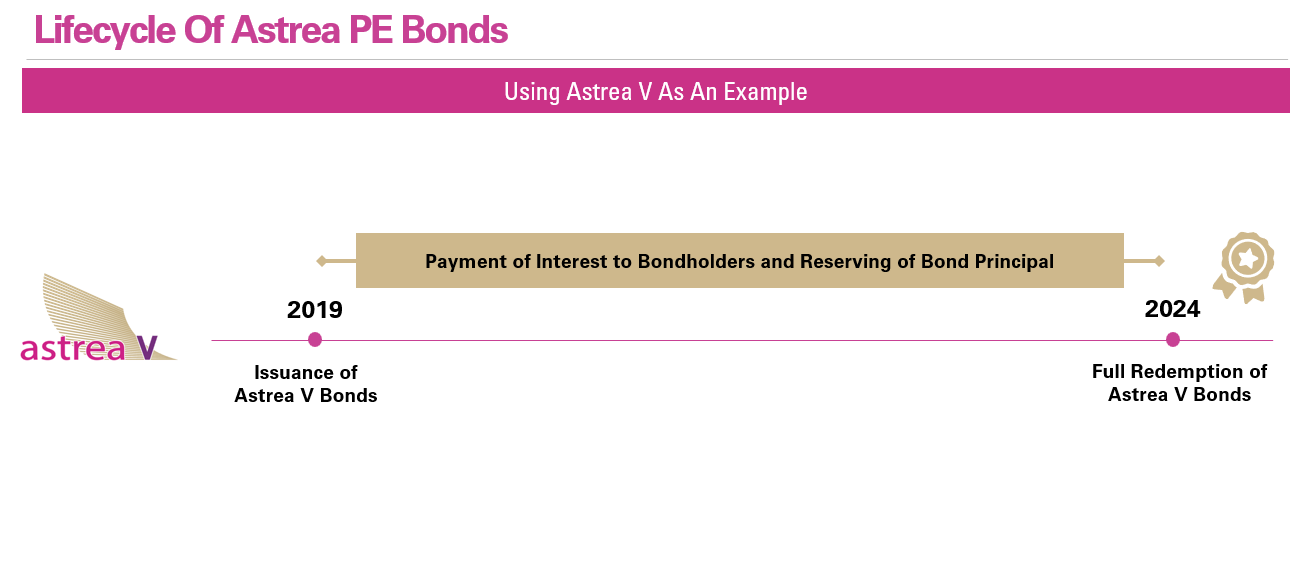

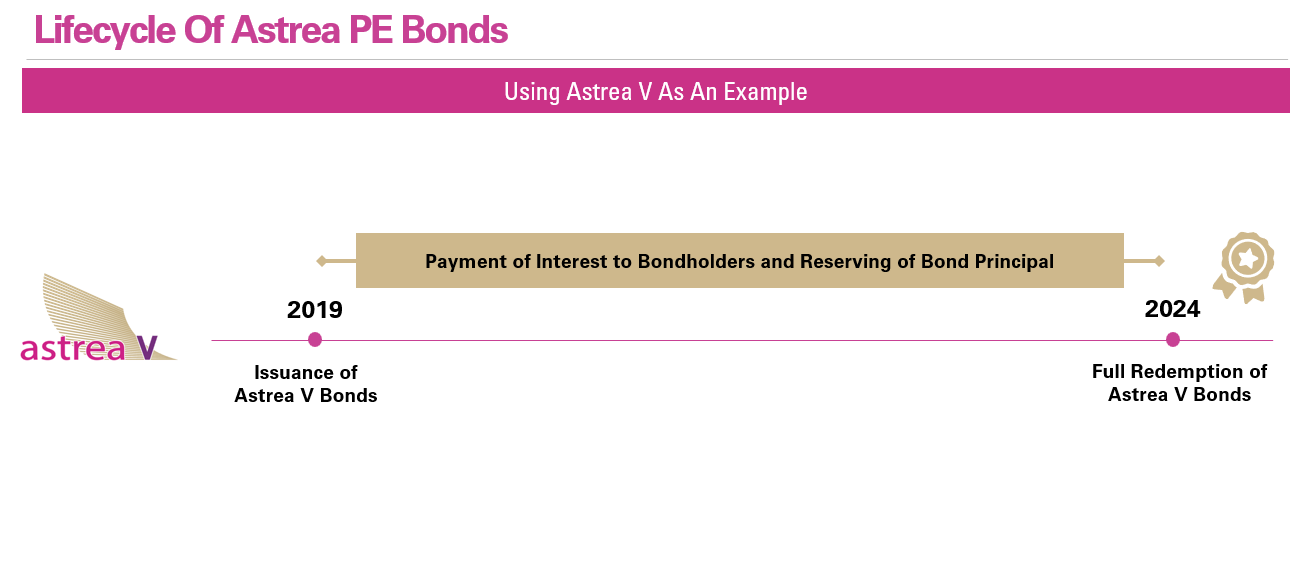

Lim Jun Jie, Director, Investor Solutions and Marketing, provided an in-depth illustration of the Astrea PE bonds life cycle using Astrea V as an example: the issuance of bonds, payment of interest, reserving mechanism for repayment of bond principal and the redemption of bonds.

He began with an overview of PE funds and how they are used to construct Astrea portfolios. He also explained how cashflows from PE funds are used to pay bond obligations through a pre-determined order of payments, also referred to as the Priority of Payments. He continued by sharing how as reserves are accumulated, the bonds are progressively de-risked. The LTV ratio of the structure also reduces over time. Finally, at the Scheduled Call Dates, if there are sufficient cash set aside to redeem the bonds and there are no outstanding Credit Facility loans, the bonds will be fully redeemed.

Back to top

Back to top

Key Takeaways

Jun Jie closed off the presentation by highlighting several takeaways from the Astrea Investor Day 2025.

- PE as an asset class has demonstrated resilient performance across market cycles

- Geopolitical and macroeconomic implications from Trump 2.0 remain to be seen

- The reserves for the various Astrea bonds continued to stay on track. All Astreas continue to fulfil their bond obligations

- The underlying portfolios of Astrea bonds are constructed to be cash flow generative and diversified, while structural safeguards are in place to mitigate downside risks

Back to top

In Conversation with Margaret and En Yaw

Margaret Lui, Azalea’s Chief Executive Officer and Chue En Yaw, Chief Investment Officer shared their insights on the Astrea bonds series. They explored topics from Astrea bond allocation to pricing, as well as the importance for investors to build portfolios that align with their own needs and risk appetites. Margaret and En Yaw also highlighted the relative relevance of bonds in all investors’ portfolios including young investors. Read the summary of the fireside chat here.

Watch the full replay of the webinar here:

Disclaimer: Please note that all information shared in this session is intended for your information only and is not an offer, invitation, or recommendation to purchase, hold or sell any securities. If you would like to receive any investment advice or recommendation, please do speak with a qualified financial advisor.

Back to top